(Disclaimer - my understanding of economics has been gained from basic reading of the popular press and a few more detailed online resources. I am very happy to stand corrected on any of the following :-))

Last week the International Monetary Fund met in Lima. Commentators agree that the outcome of their talks is worrying.

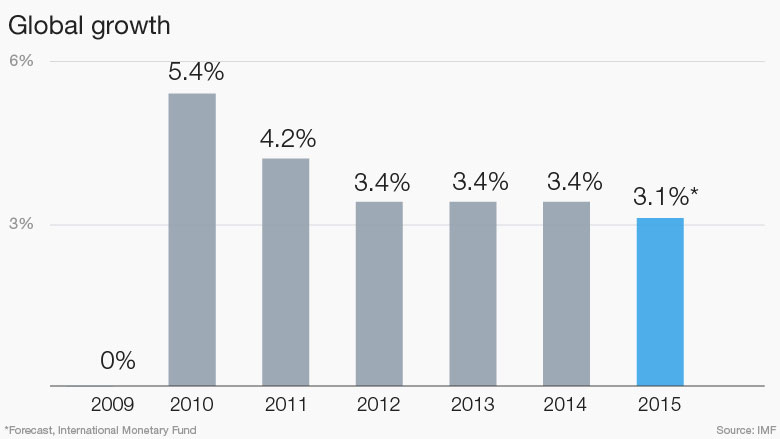

They have reduced their forecast for global growth again (for the 4th year in a row) and have concerns that the economy in emerging markets could prove very unstable if the USA raises interest rates.

They have reduced their forecast for global growth again (for the 4th year in a row) and have concerns that the economy in emerging markets could prove very unstable if the USA raises interest rates.'Despite progress in recent years, financial sector weaknesses remain in many countries, and financial risks are now elevated in emerging market' (Christine Lagarde)The advanced markets in Britain and the US have achieved a level of stability following the crash of 2008 but it's been a long time coming and has required monetary policies (quantative easing, low interest rates) that haven't produced the rate of growth they were expected to:

"Six years after the world economy emerged from its broadest and deepest postwar recession, the holy grail of robust and synchronized global expansion remains elusive," Maurice Obstfeld, head of research at the IMF.Reading about all this from my very naive level of economic understanding I must admit I agree with Larry Elliot

'These are indeed weird times. Share prices are rising and so is the cost of crude oil, but the sense in financial markets is that the next crisis is just around the corner...'There does seem to be a consensus amongst the people who "should know" that things could easily turn very rocky and a recession now would not be as easy to pull out of as it was in 2008. So why does the announcement that the Federal Reserve bank will not increase interest rates *just yet* have more power to raise the markets than serious data-driven announcements by reputable financial bodies has to depress it? (As was certainly seen in my portfolio last week). Is this just another example of the continuing (increasing?) trend towards short-termism in business and financial institutions?

There's an article from 2013 by David Kingman on the subject of short-termism which makes some very interesting points, one of which he quotes from "The Road to Recovery: How and Why Economic Policy Must Change" by Andrew Smithers: American companies are now handing back a far greater proportion of their profits to investors than the amount they invest to grow the business. In the 70's 15 times more profit was invested than giving out in dividends, now it's just 2.

It's all seems to be down to the natural human tendency towards short term gain at the expense of long term well-being, a failing that anyone who is working towards FiRe recognises, and the damage that giving in to it too often can do. Companies (and individuals) are making money and then hanging onto it or paying it out as dividends, rather than investing it back in. On a global financial level this is causing growth to slow to the point of stagnation, and quite possibly stall as far as emerging markets are concerned because they need the demand that is produced by investment from the advanced economies. There is a massive amount of debt in emerging markets which has been fuelled by low interest rates and which needs servicing somehow. If growth diminishes and interest rate rise things could come crashing down.

Hanging on to cash and failing to invest is also one of the reasons that so much wealth is getting concentrated at the top, it's just sitting there in bank accounts and not doing any work to create growth or further the famous (and contentious) "trickle-down" effect.

(btw I would argue with his definition of socialism - I think he actually means "communism" here).

The IMF is advising public spending on infrastructure projects as one of the ways advanced market countries can ease the situation, but with so much emphasis (and brain washing of the public) about the dire need to cut deficits, governments may find funding difficult unless they bite the bullet and miss a few targets (nothing new there then:-)) (And maybe if there hadn't been so much "austerity" going on in 2010 - 2012 things might have moved a lot quicker.) It does look as though Osborne has taken this to heart and the news that the pooled pension pots in the LGPS could be used to help fund things is especially welcome.

But why has business (and Government) become so short termist? If I can see the big picture from my very low level of insight then surely it's no secret that this is happening and what the likely effects are, and will be. This is an interesting question and it may be that it will take another market crash to improve things, as some commentators suggest that the last one didn't actually change policy and practise very much at all.

No one could accuse FiRe seekers of short-termism, but without Governments that build for growth, encourage investment in the future and tax wisely, and discourage cash bonus payments for company managers and the stock-piling of cash by obscenely wealthy people, we're might soon start to struggle to reach our goals.

"Share prices are rising and so is the cost of crude oil": you what? Share prices may have risen in the last few days but they are still down nearly 10% from the brief period earlier this year when they overtook the end-1999 peak. As for oil, his argument is loony. Brent crude is at about 50 bucks per barrel, rather than the 140 it touched in 2008, or the 110 it sustained for much of 2011-2014.

ReplyDeleteHi dearieme. I think he is talking about the last few days - i.e. since the latest IMF analysis/predictions. That's the way I read it anyway.

DeleteFair enough, but why base a case on the inevitable short term wiggles on graphs? They wiggle up, they wiggle down; the wiggles normally mean nothing. That's why people look at long term trends, and substantial, sudden rises and falls, not at mere "noise".

DeleteThe point he was making - and I am too - is that what came out of the IMF conference had no effect on the markets apart from to give them a boost due to the fact that the advice was given not to raise interest rates just yet - i.e. the IMF downbeat analysis on long term trends didn't register - only the short term one of no interest hike as yet.

Delete"it's just sitting there in bank accounts": but bank accounts are not vaults that simply hold money. They are loans from the creditor to the bank, which lends it on (multiplied by some large number) to someone else, even if it's only the local Central Bank.

ReplyDeleteYes, but it's not doing the same kind job it would be doing if it were invested in business, is it?

DeleteIt is if the bank lends it to businesses. Or if it lends it to an individual who thereby becomes a customer of some business.

DeleteOK. I take your point.

DeleteThere are two three problems with infrastructure expenditure. (i) It may be wickedly malinvested - see the loony HS2 as an example. (ii) Because of the planning permission system among other things, it takes forever to get projects started, never mind completed. So they can't be used to solve urgent financial problems. (iii) Governments trying to get their expenditure under some sort of control are forever cutting capital expenditure so they can go on funding continuing expenditures, however wasteful many of those continuing expenditures might be. That's three for a start.

ReplyDeleteOf course it might have done us all a pile of good if Chancellor Brown hadn't wasted so much on continuing expenditure and had bunged large wedges into roads, but that's in the past and can't be reversed. And think how much he wasted encouraging bogus "green" energy (which the coalition did nothing to reverse), or his appallingly extravagant use of PFI funding for the NHS, a textbook example of redesigning a modestly useful idea into an explosively ruinous device - so much so that I wonder whether corruption was involved at some levels.

Anyway, the point is that however much you might wish for intelligent and honest infrastructure investment to have been made years ago, it has no bearing on what to do now except, obviously, for the wisdom of refraining from bonkers expenditure.

I agree, there have been some bad (and no doubt very good) decisions in the past but I don't agree that means we shouldn't be doing it now.

DeleteDo we have an "urgent financial problem" that means these things can't be planned properly?

These are pretty much the same people who failed to see the dotcom crash and the US housing crash when they were beavering away at goldman sachs or the imf making a ton of money for themselves, why do you think they know anything now?

ReplyDeleteHi Neverland. Yes. That's why I used the phrase "should know" :-) I'd be interested in your take on what the figures/trends might mean for the future or do you think there's so many unknowns it's impossible to comment?

ReplyDeleteI think growth is going to be structurally lower due to rapidly aging populations in Europe and much of South East Asia, except India. It took eight years after its financial crisis for Japan to enter deflation we are currently six years after ours. We can't grow on ever increasing levels of government and personal debt and neither can Asia.

DeleteThere is however the opportunity of growth from supply side reform, e.g. infrastructure spending or education spending. But (and its a very big but) time and time again everywhere vested interests act to prevent this

Everyone carps about deflation but its fine if you are a saver. No one is carping about lower petrol and energy prices in the UK

Thanks Neverland - ageing populations mean less production and less tax revenue I suppose.

ReplyDeleteVery interesting post Cerridwen, the links to the videos were good as well, thanks!

ReplyDeleteI don't really care all that much if Osborne steals ideas, as long as they are good ones and he follows through with it then all good!

I agree that a lot of economic activity is ridiculously short term... My company for example just got bought out by venture capitalists who have a plan to sell at 3 or 4+ times their investment in as short a time as possible. What corners are going to be cut or what more likely what slave driving is going to be done to achieve this goal I dread to find out...!!!

Thanks TFS.

DeleteYes, hopefully Osborne will follow through. The next few years will be key I think.