Personal Finance is all about control and FiRe chasers have to be the biggest control freaks in the game. If we don't have all the strings in a firm grip, know exactly how long they are and when to pull them, how else are we going make it happen?

But there are times when the best strategy is to stop trying to make things happen and sit back and ride it out. It's fast looking as if this is one of those times. I've never "seen" a market crash or bear market. Of course I've lived through them, I've even been invested through them as I've held, and regularly paid into, a S&S ISA for around 10 years. However up until 18 months ago I wasn't remotely interested in what I was actually doing or even tracking how things were going, apart from glancing at the annual statements and thinking "that doesn't seem to have gone up much" (or the opposite). I was far too busy with kids, life, work and all the rest. This time it's very different.

Letting go of control and not being able to do anything but roll with the punches, sounds and feels more than a little scary until you realise that doing so should actually be part of the plan. Exactly as a pilot trusts his instruments to know better than he does at times, so we have to trust our PF plan to work to our best advantage when we can't see what's ahead (and as Monevator said at the weekend if you haven't got a plan get one quick:-)) Leaving the plan to do what it's meant to do is the whole reason we have it, it's there to prevent us having to make decisions when we don't have the tools to be able to do so.

I recently watched a television documentary about the terrible Staines air crash in 1972 which killed 118 people. The causes of the accident were complex but at least some of the blame has been placed with the pilot who, just before take off, had had a violent disagreement with a fellow pilot and so can be presumed to have been in an heightened emotional state. It appears that whilst the plane was coming out of take off he didn't climb quite high enough and then, when problems started to become apparent, an automatic stall warning and recovery system were overridden. As a result the plane went into a "deep stall" (from which recovery is impossible) and fell to the ground. Human intervention and faulty decision making disrupted the pre-programmed routines of the take off and tragedy ensued. The parallels with investing are clear.

(Incidentally the notion of a "deep stall" during which nothing can be done to pull the plane back up seems to me to have a financial equivalent in the situation in which many people who take out pay day loans find themselves. No matter what is done, it must feel like even the possibility of control has been lost. Apparently 44% of people who take out such loans use them for everyday essentials such as food.)

Markets across the world are tumbling, and for the first time I'm watching it happen. I'm very glad that I sold our CIS UK Growth funds a couple of months ago and took out the cash that we will need for the next two years as there is no indication of when things will recover and according to some commentators we could be in for a very bumpy time.

For now I'm going to sit tight and see what happens. (Well apart from buying £580 more of the Scottish Mortgage Trust we hold in my husband's ISA which has dropped over 7% since Friday. My husband has just received the final payment from his pension TFLS due when he retired so we have a little extra spare cash). I'll also be buying my Monkey Stocks on iii's next regular investments day towards the end of Sept. Who knows, they may be very cheap indeed by then :-)

Showing posts with label Financial Planning. Show all posts

Showing posts with label Financial Planning. Show all posts

Monday, 24 August 2015

Time to Switch to Auto PIlot

Tuesday, 18 August 2015

Student Living

Last week we finally received the great news that my son had been awarded a place on the MA course he applied for at the beginning of July.

This was a tremendous achievement on his part as the Department is rated second in the country for the subject and they describe the competition for the course as "fierce", deliberately keeping the number of students down in order to preserve a high staff to student ratio. As part of the application process he had to produce a research proposal and a piece of critical writing as his degree is in an unrelated subject (Law). He worked very hard on all this and we're extremely proud of him.

Since we now have a clear plan for our retirement and are pretty sure we have (more or less) enough to do what we want to be able to do, we have decided to gift £17,500 of our ISA savings to each of our sons as an "Opportunities Fund" to be used to allow them to do something they would otherwise not be able to do, hopefully to improve their lives permanently. This may (or may not) be directly tied to job prospects as personal satisfaction and development comes in many forms. :-) The eldest is using his to go back to University and the youngest is leaving his with us for the time being until he has a good use for it.

In addition to gifting the £17,500 we have also said that my eldest son can live rent free in our studio flat for the year. Our youngest son has already made use of the flat between his MA and PhD when he was doing some intern work and applying for funding. This is, in fact, why we bought the flat, as we only own a modest semi and having an adult son live at home can get a bit "cramped" if it goes on for any length of time. :-)

(btw I am painfully aware that my sons have both been given an educational advantage by having parents who have been able to afford to supplement student loans, internships, housing and life in general. I am ideologically opposed to the idea that education is ever something that should be allowed to exclude people for financial reasons and would never have sent them to private school, but parents these days seem increasing sucked into supporting their kids through further education if they can. As this becomes the norm surely the kids of those who cannot afford to help become actively disadvantaged? One for my conscience (and vote)).

Having now got the offer of a place we have been thinking in more depth about accommodation and my son has decided that he would rather live on campus if possible. Although our studio flat is only about 30 mins by road from the University he doesn't drive and there is only one bus an hour and none after 6.30 in the evening. He had been thinking about getting a bike as there is a cycle route for some of the way but travelling home late in winter on poorly lit roads was a bit of a worry. In addition it would be good for him to be in the thick of things and we wouldn't have to give our tenant notice (something I'm loath to do as she has been very good and is obviously happy where she is despite only signing up for 6 months initially).

However the student accommodation prices came as a bit of a shock. As a postgraduate needing a 51 week rental the full range of choice of halls was not available to him and he's basically confined to a cheaper option of £5,800 (shared bathroom) and £6,700 (en suite).

Comparing these costs to the income/costs associated with him living in our studio flat works out like this:

So, taking into account the travelling costs associated with living in the flat and the fact that living on campus entitles you to 10% discount at food outlets and bars on site means that, although the university accommodation seems mighty expensive when compared to our studio flat, it would actually be more or less cost neutral for my son to live there.

This calculation was quite interesting from another point of view. If we are getting a profit of around £3,500 pa on our studio flat and it works out that it costs our son just about the same to live in what used to be called University "Halls", surely the University is raking in huge profits at these kind of prices. Their overheads must be proportionally much smaller given the scale of their service. They have a captive rental "audience" and can control their void periods (the rooms are let out for conferences and visitors during the vacations) and service the flats using their own maintenance staff.

It all seems a bit scandalous except for the fact that we have to recognise that this is yet another reflection of the ongoing trend towards the commercialisation of education. Government funding for universities has been reduced so they have to make money somewhere. What then happens is that cheap accommodation for the students without parents with the wherewithal to help becomes scarce and the poorer students are forced out into the private sector with all its attendant stresses and difficulties, things that young people leaving home for the first time do not always have the skills to manage.

Personally I'd rather pay a bit more tax, fund the universities properly so they can provide affordable accommodation and remove tuition fees for UK students, put kids back on their own two feet with a fair and adequate grant system and make sure that further education is only seen as attractive for the right reasons by the right people. Somehow, though, this all seems to be moving further and further out of reach.

This was a tremendous achievement on his part as the Department is rated second in the country for the subject and they describe the competition for the course as "fierce", deliberately keeping the number of students down in order to preserve a high staff to student ratio. As part of the application process he had to produce a research proposal and a piece of critical writing as his degree is in an unrelated subject (Law). He worked very hard on all this and we're extremely proud of him.

Since we now have a clear plan for our retirement and are pretty sure we have (more or less) enough to do what we want to be able to do, we have decided to gift £17,500 of our ISA savings to each of our sons as an "Opportunities Fund" to be used to allow them to do something they would otherwise not be able to do, hopefully to improve their lives permanently. This may (or may not) be directly tied to job prospects as personal satisfaction and development comes in many forms. :-) The eldest is using his to go back to University and the youngest is leaving his with us for the time being until he has a good use for it.

In addition to gifting the £17,500 we have also said that my eldest son can live rent free in our studio flat for the year. Our youngest son has already made use of the flat between his MA and PhD when he was doing some intern work and applying for funding. This is, in fact, why we bought the flat, as we only own a modest semi and having an adult son live at home can get a bit "cramped" if it goes on for any length of time. :-)

(btw I am painfully aware that my sons have both been given an educational advantage by having parents who have been able to afford to supplement student loans, internships, housing and life in general. I am ideologically opposed to the idea that education is ever something that should be allowed to exclude people for financial reasons and would never have sent them to private school, but parents these days seem increasing sucked into supporting their kids through further education if they can. As this becomes the norm surely the kids of those who cannot afford to help become actively disadvantaged? One for my conscience (and vote)).

Having now got the offer of a place we have been thinking in more depth about accommodation and my son has decided that he would rather live on campus if possible. Although our studio flat is only about 30 mins by road from the University he doesn't drive and there is only one bus an hour and none after 6.30 in the evening. He had been thinking about getting a bike as there is a cycle route for some of the way but travelling home late in winter on poorly lit roads was a bit of a worry. In addition it would be good for him to be in the thick of things and we wouldn't have to give our tenant notice (something I'm loath to do as she has been very good and is obviously happy where she is despite only signing up for 6 months initially).

However the student accommodation prices came as a bit of a shock. As a postgraduate needing a 51 week rental the full range of choice of halls was not available to him and he's basically confined to a cheaper option of £5,800 (shared bathroom) and £6,700 (en suite).

Comparing these costs to the income/costs associated with him living in our studio flat works out like this:

- After tax income from rental (estimated as it depends if any further repairs are required and\or the tenant gives notice): £3,700

- Estimated utilities (electricity, broadband, water) to pay if in flat - currently covered by tenant: £1,000

- Council Tax (currently covered by tenant): £1,200

So, taking into account the travelling costs associated with living in the flat and the fact that living on campus entitles you to 10% discount at food outlets and bars on site means that, although the university accommodation seems mighty expensive when compared to our studio flat, it would actually be more or less cost neutral for my son to live there.

This calculation was quite interesting from another point of view. If we are getting a profit of around £3,500 pa on our studio flat and it works out that it costs our son just about the same to live in what used to be called University "Halls", surely the University is raking in huge profits at these kind of prices. Their overheads must be proportionally much smaller given the scale of their service. They have a captive rental "audience" and can control their void periods (the rooms are let out for conferences and visitors during the vacations) and service the flats using their own maintenance staff.

It all seems a bit scandalous except for the fact that we have to recognise that this is yet another reflection of the ongoing trend towards the commercialisation of education. Government funding for universities has been reduced so they have to make money somewhere. What then happens is that cheap accommodation for the students without parents with the wherewithal to help becomes scarce and the poorer students are forced out into the private sector with all its attendant stresses and difficulties, things that young people leaving home for the first time do not always have the skills to manage.

Personally I'd rather pay a bit more tax, fund the universities properly so they can provide affordable accommodation and remove tuition fees for UK students, put kids back on their own two feet with a fair and adequate grant system and make sure that further education is only seen as attractive for the right reasons by the right people. Somehow, though, this all seems to be moving further and further out of reach.

Saturday, 13 June 2015

Cashing In

At the beginning of the month I bit the bullet and sold the last of our CIS UK Funds.

At the beginning of the month I bit the bullet and sold the last of our CIS UK Funds.With that job done we went away for a week in Babbacombe. We had great weather, consumed far too much good food and drink and made a valiant attempt to mitigate the effects by hiking up and down chunks of the South West Coast Path. We're back home now and the cash (around £10,000) is sitting in our current account. The question is what should I do with it?

The likelihood is that it will be needed late Autumn/Spring in instalments to fund my son's living costs when he returns to full time education. However this is by no means certain as he has still to secure a place on the course. He may even have to delay his plans till next year if he isn't successful this time around, in which case our whole financial situation may have changed if I do get VR/early retirement next April.

The most sensible thing to do would probably be to open another Santander 123 current account. Our joint one is (or will shortly be) maxed out. However it is possible to open individual ones as well so this option is a strong contender and would be the one that would probably produce the highest guaranteed interest. However, I'm already managing 5 current accounts and can't really be bothered with yet another set of direct debits and monthly money shuffles.

None of my existing banks offer interest rates worth having on their instant access accounts so I'm currently tending to favour Premium Bonds. I've done some reading on the subject, Monevator is (as always) an excellent resource with an additional useful link to a recent Guardian article, so I know the odds of winning big are very slim but in the absence of anything better to do with the cash I think I'm going to set up an account and see how things go. The MSE Forum thread makes interesting reading so I've been working my way through that but I'd be interested to hear about any experience/winnings in the comments.

Whilst we're on the subject of cash I have a slightly thornier problem around what to do with a big chunk of it which will be landing in my SIPP when I transfer my old CIS FSAVC in at some point soon. I've been delaying doing this because the pension has been doing OK (8% in 2014 and 5.78% so far this year) but I think the time has now come to make a move.

I'm hopeful that the transfer into my Fidelity SIPP will be straightforward and I have been assured by Fidelity that there shouldn't be a problem, but it is an old "with profits" fund with a Guaranteed Annuity Rate of 6% so I'm wondering if I might be asked to take advice before transferring out. Hopefully not. It forms a big chunk of the money that will see me through before I take my LGPS pension at 60 (if I don't get early retirement before then) and I don't really want to have to fork any of it out in advisor fees before I'm allowed to move it somewhere I can get at it in drawdown. (The transfer value on my last statement as of March 2015 was £19,270.)

In preparation for the move I've been considering the options for it in my SIPP. I could just leave it in cash which is probably the way I'll go as there's a strong chance it will be needed in 1 - 3 years time. I've yet to completely bottom out Fidelity's drawdown but the options look pretty flexible and I'm hopeful of being able to fit them around whichever scenario pans out as far as my retirement goes over the next few years. So, cash would probably do fine for the transfer in and then I'll sell the additional £15,000 worth of funds I have in there - sooner rather than later to try to avoid a big loss.

(Incidentally I did notice that Fidelity have a "Cash Fund" which I'm struggling to see the advantage of. It has total costs inside a SIPP of 0.55% and has made 0.25% max going back to 2011. Can anyone help me out by explaining why someone would use this?)

Monday, 1 June 2015

May 2015 Update

I have decided to change the format of my portfolio update this month due to the fact I'm probably going to shift some of it down into cash in the next 2 years rather than leave our ISAs fully invested and use them to draw income. This means that the "big picture" is what is important so I am going to be recording our portfolio as a whole, which includes my LGPS AVC's (but not my DB pension itself) and our cash accounts.

I have done a "best guess" on what might need to happen over the next 6 - 9 months due to the fact that we might need to pay around £7,500 in tuition fees and gift both sons £5,000 each; the eldest to help with living expenses for the period and the youngest to add to his savings. The younger one is quite happy to leave the remainder of his gift with us as at the moment.

I am hoping to limit the move to cash to what we will actually need, as it's looking more and more hopeful that VR next April is on the cards. A little investigation into the pension rules and asking a few questions has revealed that giving access to my pension unreduced could well be part of the deal. The most likely scenario seems to be that I would be let go on "efficiency" grounds which would mean that I would have access to the pension but no redundancy money. Although that would reduce my cash "hand out" it would be a far superior long term result from my point of view and I would still receive cash in the form of my LGPS TFLS (£13,600), my LGPS AVCs (around £4,500) and a TFLS from my SIPP (£8,500) which gives me £26,600. This should be more than enough cash to gift a further £5,000 to the eldest son and put the £12,500 away in an ISA for the youngest (or whatever he thinks best).

I should know by the Autumn if VR is going to happen so at the moment I'm trying to do as little as possible, but as much as possible, to secure the cash and avoid having to sell equities at a low point. As there are two legacy funds in our ISA's that I would not buy if I were starting with a clean slate this is where I intend to start selling. The funds are CIS UK Growth and CIS UK Income and Growth. Both have actually done quite well over the last year or so and are currently near (or in) the top quartile for funds of their type. Although the fees are high at 1.5% Interactive Investor has been refunding half of this so I have been happy to hang onto them as part of our UK exposure. But, as we now need cash I think it's time, or very close to time, to sell. The likelihood of a wobbly UK market due to the prospect of an EU referendum only strengthens my feeling that this is the best move to make. Between them the two funds will raise just over £10,000 and so, along with the cash in our Santander account, should give us the cash buffer we (might) need for the next 9 months.

I know selling a big chunk of our UK stock like this will completely skew my asset allocations but I will have to think about rebalancing once there is a clearer picture of our whole financial situation. At the moment there are far too many unknowns, so doing what seems best at the time is as good a plan as any. :-)

I have done a "best guess" on what might need to happen over the next 6 - 9 months due to the fact that we might need to pay around £7,500 in tuition fees and gift both sons £5,000 each; the eldest to help with living expenses for the period and the youngest to add to his savings. The younger one is quite happy to leave the remainder of his gift with us as at the moment.

I am hoping to limit the move to cash to what we will actually need, as it's looking more and more hopeful that VR next April is on the cards. A little investigation into the pension rules and asking a few questions has revealed that giving access to my pension unreduced could well be part of the deal. The most likely scenario seems to be that I would be let go on "efficiency" grounds which would mean that I would have access to the pension but no redundancy money. Although that would reduce my cash "hand out" it would be a far superior long term result from my point of view and I would still receive cash in the form of my LGPS TFLS (£13,600), my LGPS AVCs (around £4,500) and a TFLS from my SIPP (£8,500) which gives me £26,600. This should be more than enough cash to gift a further £5,000 to the eldest son and put the £12,500 away in an ISA for the youngest (or whatever he thinks best).

I should know by the Autumn if VR is going to happen so at the moment I'm trying to do as little as possible, but as much as possible, to secure the cash and avoid having to sell equities at a low point. As there are two legacy funds in our ISA's that I would not buy if I were starting with a clean slate this is where I intend to start selling. The funds are CIS UK Growth and CIS UK Income and Growth. Both have actually done quite well over the last year or so and are currently near (or in) the top quartile for funds of their type. Although the fees are high at 1.5% Interactive Investor has been refunding half of this so I have been happy to hang onto them as part of our UK exposure. But, as we now need cash I think it's time, or very close to time, to sell. The likelihood of a wobbly UK market due to the prospect of an EU referendum only strengthens my feeling that this is the best move to make. Between them the two funds will raise just over £10,000 and so, along with the cash in our Santander account, should give us the cash buffer we (might) need for the next 9 months.

I know selling a big chunk of our UK stock like this will completely skew my asset allocations but I will have to think about rebalancing once there is a clearer picture of our whole financial situation. At the moment there are far too many unknowns, so doing what seems best at the time is as good a plan as any. :-)

Monday, 25 May 2015

Gifting the Inheritance Away

I have two adult sons who have both done fairly well for themselves but have followed very different paths.

The eldest has lived in rented accommodation in London since graduating. At first he lived with a succession of house mates and then a long-term girlfriend but he is now on his own which is very expensive but at 31 he feels he needs his own place. He has a job that pays him well enough to live in London and has paid off his student loan but he has never saved beyond a few hundred for his next holiday. Recently he has become very disillusioned with his career (a para-legal job in the health services). His salary is barely creeping up, promotion prospects are poor and his pension is being down graded quite drastically. Basically he is bored, burned out and bordering on unhappy.

My youngest son has not yet ventured out of full time education after moving from a degree to an MA and then a PhD which he is just finishing. He has done some teaching work along the way but has mainly been funded via scholarships and bursaries which he has won due to hard work and excellent academic results. He actively enjoys living frugally which has helped. His friendship group is large and very supportive and he's very happy where he is.

Both my sons have a potentially life-shortening genetic illness. I mention this because it does make a difference to the decision-making process that my husband and I have just gone through. We have decided

Both my sons have a potentially life-shortening genetic illness. I mention this because it does make a difference to the decision-making process that my husband and I have just gone through. We have decided

to give/gift/pay out around half of our ISA savings to our sons now, when they need it, rather than continue to save it in case we have a "rainy day" (whatever form that might take).

As we aren't even proper "pensioners" yet we haven't really thought much about inheritance. We don't expect to end up paying any inheritance tax given that a surviving married partner also inherits their partner's unused allowance so this means that the total estate would need to be over £650,000 before any is due? Someone please correct me if this is wrong.

But in any case the timing of inheritance is something over which you have no control and doesn't fit in with anyone's plans. Why would we want to sit on cash "in case" when there is currently a valuable use for it. Waiting till we die to pass the money on to our sons makes less sense the more I think about it. We have around £70,000 in our ISAs which only form part of our retirement plan in that it would be used to provide a small amount of income (maybe about £3,000 a year) and be a care-cost buffer if we need it. In actual fact the costs of care are so astronomical that if residential care were to be needed for either of us on a long term basis, whether we had £35,000 or £70,000 would be soon become academic because it would vanish in such a short period of time. This is a scary thought but it does mean that keeping the ISA funds for this purpose doesn't make a whole lot of sense.

So we have decided to manage the money so that our sons can have around £17,500 each over the next couple of years. My eldest son can then leave his job and do a Masters in a subject he will enjoy. The change in him since we talked about this and told him of our decision is remarkable. He's full of enthusiasm and plans for the future, whereas before he seemed to be losing his naturally positive outlook on things. I defy anyone to tell me that this is the wrong thing to do.

I need to do some work on how we can do this and what would be the best way to "gift" it. I also need to bottom out which bits of our ISAs to sell and move into cash, whether to give the money as lump sum(s) or regular payments and investigate implications for taxation. In addition to the money my eldest son will hopefully be living in our studio flat for a year whilst he does the course so I also need to work around the loss of the rent for that period. Back to the spreadsheets.

In the middle of all this I'm expecting to put in my application for VR during the summer which might, or might not be accepted. Interesting times :-)

The eldest has lived in rented accommodation in London since graduating. At first he lived with a succession of house mates and then a long-term girlfriend but he is now on his own which is very expensive but at 31 he feels he needs his own place. He has a job that pays him well enough to live in London and has paid off his student loan but he has never saved beyond a few hundred for his next holiday. Recently he has become very disillusioned with his career (a para-legal job in the health services). His salary is barely creeping up, promotion prospects are poor and his pension is being down graded quite drastically. Basically he is bored, burned out and bordering on unhappy.

My youngest son has not yet ventured out of full time education after moving from a degree to an MA and then a PhD which he is just finishing. He has done some teaching work along the way but has mainly been funded via scholarships and bursaries which he has won due to hard work and excellent academic results. He actively enjoys living frugally which has helped. His friendship group is large and very supportive and he's very happy where he is.

Both my sons have a potentially life-shortening genetic illness. I mention this because it does make a difference to the decision-making process that my husband and I have just gone through. We have decided

Both my sons have a potentially life-shortening genetic illness. I mention this because it does make a difference to the decision-making process that my husband and I have just gone through. We have decided to give/gift/pay out around half of our ISA savings to our sons now, when they need it, rather than continue to save it in case we have a "rainy day" (whatever form that might take).

As we aren't even proper "pensioners" yet we haven't really thought much about inheritance. We don't expect to end up paying any inheritance tax given that a surviving married partner also inherits their partner's unused allowance so this means that the total estate would need to be over £650,000 before any is due? Someone please correct me if this is wrong.

But in any case the timing of inheritance is something over which you have no control and doesn't fit in with anyone's plans. Why would we want to sit on cash "in case" when there is currently a valuable use for it. Waiting till we die to pass the money on to our sons makes less sense the more I think about it. We have around £70,000 in our ISAs which only form part of our retirement plan in that it would be used to provide a small amount of income (maybe about £3,000 a year) and be a care-cost buffer if we need it. In actual fact the costs of care are so astronomical that if residential care were to be needed for either of us on a long term basis, whether we had £35,000 or £70,000 would be soon become academic because it would vanish in such a short period of time. This is a scary thought but it does mean that keeping the ISA funds for this purpose doesn't make a whole lot of sense.

So we have decided to manage the money so that our sons can have around £17,500 each over the next couple of years. My eldest son can then leave his job and do a Masters in a subject he will enjoy. The change in him since we talked about this and told him of our decision is remarkable. He's full of enthusiasm and plans for the future, whereas before he seemed to be losing his naturally positive outlook on things. I defy anyone to tell me that this is the wrong thing to do.

I need to do some work on how we can do this and what would be the best way to "gift" it. I also need to bottom out which bits of our ISAs to sell and move into cash, whether to give the money as lump sum(s) or regular payments and investigate implications for taxation. In addition to the money my eldest son will hopefully be living in our studio flat for a year whilst he does the course so I also need to work around the loss of the rent for that period. Back to the spreadsheets.

In the middle of all this I'm expecting to put in my application for VR during the summer which might, or might not be accepted. Interesting times :-)

Labels:

Financial Planning,

Inheritance,

Investment Platform

Saturday, 25 April 2015

Fire Fighting after FiRe - How to Manage an Emergency Fund when the Salary Stops.

The standard advice about a emergency fund is that it should contain 3 to 6 months' worth of expenses (or even more - for a heated debate on this take a look at this recent MSE thread). The reason given for needing to keep this amount of cash is "what if you lose your job?" However, by definition, this can't happen in retirement (although there are many flavours to FI, some of which will involve earning an income of some kind). At this point we need to rethink our calculation and reassess our actual requirements. Will we need an "emergency fund" at all when we are drawing a pension or living on savings/investments? If we do need one how should we assess how much we need to keep in it, and, crucially, how do we top it up when it gets depleted.

The standard advice about a emergency fund is that it should contain 3 to 6 months' worth of expenses (or even more - for a heated debate on this take a look at this recent MSE thread). The reason given for needing to keep this amount of cash is "what if you lose your job?" However, by definition, this can't happen in retirement (although there are many flavours to FI, some of which will involve earning an income of some kind). At this point we need to rethink our calculation and reassess our actual requirements. Will we need an "emergency fund" at all when we are drawing a pension or living on savings/investments? If we do need one how should we assess how much we need to keep in it, and, crucially, how do we top it up when it gets depleted.There is an interesting discussion about this on "Get Rich Slowly" - Is it Possible you don't need an Emergency Fund which started me thinking about our own situation. What kind of emergencies could we encounter? - fire, flood, pestilence (a plague of pigeons :-))? but anything catastrophic of this nature would be more than likely be covered by insurance. Medical emergencies figure heavily for Americans - according to Lisa's figures they represent the most common financial emergency, but they shouldn't cause so much concern to UK citizens. (However who knows what the future might bring regarding the NHS. As an aside one of the main reasons we would like to have a fair amount left to pass onto our sons is that they both have an inherited medical condition that could mean they have periods when they can't work in the future, or need drugs that the NHS will no longer supply. This worry and the threat of the possibility of one or both of us needing care home support is why we would like to leave our ISA funds in tact for as long as possible - so maybe this is a form of long-term medical emergency fund in itself.)

Our emergencies are most likely car, white good or kid related. I do not count holidays as an emergency (although taking one sometimes is :-) - probably not so much the case when you retire). Holidays, despite being paid for in chunks of cash, will continue be paid for by credit card when we retire and have been accounted for as part of our day to day expenses. Thinking about what has happened in the past and when we have unexpectedly needed cash it has generally been to make loans to the kids (some paid back, some not) for things like clearing student overdrafts, help with rent deposits and prop-ups so that they could complete their education. We have not (as yet) joined the growing number of parents who have helped their kids with buying a house but several of my friends have. If we do go down this route though it won't be an emergency. So, in the past the kind of figure we would be looking at that we might need at short notice could be up to around £3,000. In certain situations this could happen maybe 3 times a year - major car repair, fridge and telly both pack-up and the dog needs an operation. This semi-educated guesswork gives me a figure for our own particular emergency fund of £12,000 going forward. I'm happy with that, it can continue to sit in our "high" interest Santander 123 account and hopefully seldom get touched.

But that's not the whole picture. In addition to this I do have to look at the bits of our income post retirement that aren't guaranteed. From when I retire at 58 and until I'm 66 and my state pension kicks in not all our required income will be coming from guaranteed sources. We will be relying on our rental income and dividends from our ISAs to make up between 30% (58 to 60) and 15% (60 to 66) of our £30,000 income. Neither of these sources are sure-fire or inflation linked. They are liable to fluctuate and may not always be available, or we may not always want to take them. In the case of the rental income we may have an extended void period or large repairs that eat into the rent. (I do only ever assess the annual income from the flat on 10 months' worth of rent but I want to be super careful here). In the case of the ISA dividends we might want to take advantage of a market drop to plough them back in and buy when things are cheap, rather than depleting the funds when they are low. In these situations extra cash in the emergency fund might come in handy.

Given that between £4,500 and £9,000 of our income over those 8 years is not entirely secure, it probably makes sense to have at least a years' worth of the average required (£6,750) available in the emergency fund. This should be added to my original £12,000 and can all be fitted into the Santander 123 giving a total emergency fund of £19,000.

So, I have my figure, we need a £19,000 cash emergency fund until I am 66 when it can probably be run down slightly. Getting the cash into the fund is doable - we currently have just under £14,000 as we've just used some cash to change the car. Making up the extra £5,000 won't be a problem over the next few months before my husband retires. The question that bothers me is how to keep it topped up once we have both retired and are maxing out our income. The whole point of the fund is that it will get used - although it would be nice if it didn't - so how do we fill it back up to comfort level when it does?

The only solution I can think of is to make a point of moving any capital gain from the ISA into cash as and when it becomes available? I have been doing a bit of rebalancing recently using a couple of funds that have made over 25% gain, sold some stock and bought more of assets I'm still a little low on. Should the same strategy be used to keep an emergency fund at the required level? It certainly makes sense from a "sell high" point of view and the whole point of the emergency fund is to avoid a situation whereby you are forced to sell when stocks are low. Of course the potential for more growth is lost by moving down into low interest cash but you are at the same time dodging the bullet of real loss if you need to sell at wrong time. I'm proposing the following sequence of events:

- Son needs help with the airfare and living expenses for interview and then relocation in Toronto (this might actually be happening which is very exciting :-) He's just finished his PhD and is applying for a research position there.)

- Remove £5,000 from the emergency fund

- Check ISA for any funds that are showing signs of good growth (this is independent of any ongoing asset rebalancing that is going on).

- Sell an appropriate amount of any funds that are showing more than a pre-defined amount of growth (15%, 25%?)

- Top up the emergency fund

- If everything in the ISA is showing red do nothing, wait but rebalance ISA annually as usual if necessary. Wait. Wait. Hope emergency fund holds out despite deciding to use cash from it instead of taking dividends out of the ISA during the bad patch. Wait.

- Breathe sigh of relief as markets start to rise again. Wait for strong growth and eventually take some profit and rebuild the emergency fund.

Any other ideas anyone?

Thursday, 9 April 2015

Defining the Benefit. When to take a Defined Benefit pension.

Timing risk and when to draw a Defined Contribution pension are well documented. I was fascinated to read RIT's recent post on this in which talks about SWR and links to a video which uses historical data to illustrate that when a pension "pot" is put into drawdown is a major factor in determining whether or not it will last and that no withdrawal rate (whether 4%, or even less) can be regarded as "absolutely" safe but must be assessed in the context of the "value" of the markets at the time the pension is taken.

I was fascinated, but in a detached kind of way, because this kind of deliberation about "when" has never been considered necessary for those of us lucky enough to have index-linked DB pensions. Received wisdom is simple - never take a DB pension before scheme payment age if at all possible, actuarial reduction is to be avoided at all costs. But I've been thinking about this recently and have come to the conclusion that deciding when to take a DB pension is not that simple after all. We may think that it is but that is only because, unlike with a DC pension, it is easy to count the cost of taking the pension early, when what we should actually be doing is making some effort to measure this cost against the benefit.

As an example my own figures come out like this: (I currently have £35,000 in my SIPP and was intending to boost this up to around £50,000, retire at 58 and defer my LGPS till 65).

But what this calculation doesn't take into account are the benefits attached to:

All the above add up to a clear win, for me, to taking my pension early despite the 24% reduction. This win is personal and depends on my lifestyle and situation, what it actually costs in monetary terms is just one of the considerations. After thinking it all through I'm pretty sure which way to go and have revised my targets accordingly. In fact the only one that I haven't yet hit is the one that means I need to add another £1,000 pa to my LGPS pension and that is simple to satisfy - I just need to keep working for another 2 years.

On a more general note, if things stay as they are with DB pensions and public sector ones in particular - which is unlikely but does provide food for thought - then it seems probable that some sort of "retirement age" gap could grow up between those with DC pensions, who let the decision on when they want to retire drive their saving and investing plans because no-one can actually tell them in advance what will be the best time to go, and those on DB pensions who just "expect" to have to stay in work until they reach scheme retirement age (which is increasingly being brought in line with State Retirement Age). Of course, there is nothing to stop DB pensioners funding (slightly) early retirement but it does need the foresight to set up an additional personal pension, a fair excess of salary over needs and a willingness to confront the horned beast of actuarial reduction, and assess the benefits of taking a hit on total pension received, in the context of the whole retirement plan, rather than with "just don't do it" blinkers on.

Knowing the financial cost of something is an advantage, but it can be a brake in just the same way as not knowing can (and maybe even more so). When deciding when to take a pension we should all make sure we take due diligence with our cost/benefit analysis and never forget that the only thing we can really be sure of is the value of time.

I was fascinated, but in a detached kind of way, because this kind of deliberation about "when" has never been considered necessary for those of us lucky enough to have index-linked DB pensions. Received wisdom is simple - never take a DB pension before scheme payment age if at all possible, actuarial reduction is to be avoided at all costs. But I've been thinking about this recently and have come to the conclusion that deciding when to take a DB pension is not that simple after all. We may think that it is but that is only because, unlike with a DC pension, it is easy to count the cost of taking the pension early, when what we should actually be doing is making some effort to measure this cost against the benefit.

As an example my own figures come out like this: (I currently have £35,000 in my SIPP and was intending to boost this up to around £50,000, retire at 58 and defer my LGPS till 65).

- Pension if I take it at 65 - £9,300. Tax free lump sum - £13,000. (When taken this this would be partly subject to 20% tax as I have a small amount of rental income, plus state pension would become payable at 66).

- Pension if I take it at 60 - £7020. Tax free lump sum - £11,500). (This would be taken tax free until 66 as I intend to pay myself just enough out of my SIPP to take me up to the PA).

But what this calculation doesn't take into account are the benefits attached to:

- Not having to stretch our finances to allow me to retire at 58 (in other words, the pressure is off as I already have enough in my SIPP. In fact I shouldn't put any more in there as I am already at the limit of what I can use tax efficiently should I decide to access my LGPS at 60)

- Being able to take advantage of a tax free lump sum of £8,500 from my SIPP at 58 which could be re-invested in my ISA, in whole or in part. The rest of my SIPP would adequately fund the two years before I taking my LGPS.

- Being able to access my LGPS tax free lump sum and AVCs at 60 instead of 65 (when my husband would be 71 and we may not be able to put it to such good use). My TFLS/AVC fund currently stands at around £16,000 but could be bumped up to £25,000 by paying what I was going to put into my SIPP for the next two years into my AVC instead. (It is a perk of the LGPS pre-2014 that the whole of the AVC fund can be used to boost the tax free lump sum - subject to certain upper limits that don't apply to me).

- A big part of my income between 60 and 65 would be index-linked and risk free (via the LGPS) rather than managed myself via my SIPP (and therefore subject to market risk or inflation risk if I move it down into cash).

All the above add up to a clear win, for me, to taking my pension early despite the 24% reduction. This win is personal and depends on my lifestyle and situation, what it actually costs in monetary terms is just one of the considerations. After thinking it all through I'm pretty sure which way to go and have revised my targets accordingly. In fact the only one that I haven't yet hit is the one that means I need to add another £1,000 pa to my LGPS pension and that is simple to satisfy - I just need to keep working for another 2 years.

On a more general note, if things stay as they are with DB pensions and public sector ones in particular - which is unlikely but does provide food for thought - then it seems probable that some sort of "retirement age" gap could grow up between those with DC pensions, who let the decision on when they want to retire drive their saving and investing plans because no-one can actually tell them in advance what will be the best time to go, and those on DB pensions who just "expect" to have to stay in work until they reach scheme retirement age (which is increasingly being brought in line with State Retirement Age). Of course, there is nothing to stop DB pensioners funding (slightly) early retirement but it does need the foresight to set up an additional personal pension, a fair excess of salary over needs and a willingness to confront the horned beast of actuarial reduction, and assess the benefits of taking a hit on total pension received, in the context of the whole retirement plan, rather than with "just don't do it" blinkers on.

Knowing the financial cost of something is an advantage, but it can be a brake in just the same way as not knowing can (and maybe even more so). When deciding when to take a pension we should all make sure we take due diligence with our cost/benefit analysis and never forget that the only thing we can really be sure of is the value of time.

Sunday, 8 March 2015

The Mystique of the Market and the Common Man

I started this blog about a year ago now so I thought I'd take another look at the "theme" I chose when I did so - the idea that investing is a dark art accessible only to the select few. The slant I took was, of course, a little tongue-in-cheek, but there is a serious side to this issue. The proportion of the population who invest in the markets (other than in a "second hand way" via their pension funds - and in this case many people don't even realise this is what is happening) is very small.

The Stocks and Shares ISA, which is the most accessible and widely publicised route into investing, is still a very poor relation to the Cash ISA and this trend has changed very little despite the very poor returns of cash ISAs in recent years. Statistics show that Cash ISAs consistently form over 70% of the total takeup.1

This disparity is also reflected in the PF blogscape and on sites such as MSE. There are still relatively few UK investment bloggers, and the majority of these are people who work, or have worked, in banking or financial institutions, so cannot consider themselves ordinary mortals :-). (The situation in the US seems to be a little different where Dividend Investing is more popular).

Despite the relative lack of involvement in investing in the UK there's certainly no lack of interest in money itself, evidenced by the vast amount of Budgeting, Saving and DebtFree blogging and forum participation going on.

Why should this be?

Looking back at my own journey I can understand the reticence people feel. For most of us money is hard earned and we are very loath to "play" with it. I believe that this is a pivotal point. Money, for the majority of people, is something that is tied tightly to work. We earn it. It is not something that can be grown. It really does not "grow on trees". However, the select few who grow up in a culture of inheritance see things from a very different point of view. For them what essentially makes money is money itself, compound interest is their biggest friend and volatility holds no real fear. There's a whole different mindset involved and it's one which it is difficult to introduce to people who actually need what they've got and would really struggle if it was lost.

Putting a little away in a savings account and watching it grow slowly is one thing, but tossing it into the seething cauldron of the stock market feels very much like losing control. In the eyes of the general public investing still has that impenetrable fence of, danger, magic, and privilege surrounding it. You need financial qualifications and "insider" knowledge to be able to invest, or you need to be able to pay someone who does. It's much safer to stay on the other side of that fence.

This apprehension is gradually being addressed by the increasing availability of advice and information on the Internet forums such as MSE, blogs such as Monevator, and the DIY platforms themselves. Helpful "Investing Made Easy" books are readily available and understandable. I have used of a lot of this material myself over the last year and I'm really grateful for the time taken by the authors and participants to help and inform. But all this help should be making more inroads than it is.

I suppose we could ask why does it matter? If the majority of people are not comfortable with investing then why should they be encouraged to do so. This might be a sensible response in a world where not so much lay at the door of the individual. In the days of the Defined Benefit pension and co-operative financial institutions such as Building Societies personal finance didn't need to be quite so personal. However many sensible people these days are not even including receiving a state pension in their financial planning. It seems that, (sadly in my opinion - and dangerously too) the state is "letting go" of its responsibility to be mindful of the financial well-being of all its citizens.

Earned wealth is dropping and "grown" wealth is growing. This makes it even more important that ordinary people (what used to equate to the working and lower middle class) start to see the benefit of investing their money. Maybe the newer types of "investment" that don't carry the old fear factor - things like peer-to-peer lending and crowd funding might be a less daunting way into the whole process for some people. Despite the fact that they are often inherently just as risky, they do seem more transparent than the whole cult of "Wealth Management", with its performance charts, asset allocation, diversification, ETFs, Bonds and a multitude of other incomprehensible terms, rules, calculations and acronyms.

All in all, I have had a very interesting year teaching myself the ways of the dark art. I have learnt a lot and although I know that I still have a lot to learn, I have found the whole process incredibly satisfying and engaging. What worries me is that most people don't have the time, inclination or interest to do the legwork, nor the money to pay someone else to do it for them. This fact will do nothing to halt the growing trend towards wealth inequality.

Investing still isn't simple enough, probably because it isn't in the interest of the industry to make it so. This is something we should all be concerned about.

The Stocks and Shares ISA, which is the most accessible and widely publicised route into investing, is still a very poor relation to the Cash ISA and this trend has changed very little despite the very poor returns of cash ISAs in recent years. Statistics show that Cash ISAs consistently form over 70% of the total takeup.1

This disparity is also reflected in the PF blogscape and on sites such as MSE. There are still relatively few UK investment bloggers, and the majority of these are people who work, or have worked, in banking or financial institutions, so cannot consider themselves ordinary mortals :-). (The situation in the US seems to be a little different where Dividend Investing is more popular).

Despite the relative lack of involvement in investing in the UK there's certainly no lack of interest in money itself, evidenced by the vast amount of Budgeting, Saving and DebtFree blogging and forum participation going on.

Looking back at my own journey I can understand the reticence people feel. For most of us money is hard earned and we are very loath to "play" with it. I believe that this is a pivotal point. Money, for the majority of people, is something that is tied tightly to work. We earn it. It is not something that can be grown. It really does not "grow on trees". However, the select few who grow up in a culture of inheritance see things from a very different point of view. For them what essentially makes money is money itself, compound interest is their biggest friend and volatility holds no real fear. There's a whole different mindset involved and it's one which it is difficult to introduce to people who actually need what they've got and would really struggle if it was lost.

Putting a little away in a savings account and watching it grow slowly is one thing, but tossing it into the seething cauldron of the stock market feels very much like losing control. In the eyes of the general public investing still has that impenetrable fence of, danger, magic, and privilege surrounding it. You need financial qualifications and "insider" knowledge to be able to invest, or you need to be able to pay someone who does. It's much safer to stay on the other side of that fence.

This apprehension is gradually being addressed by the increasing availability of advice and information on the Internet forums such as MSE, blogs such as Monevator, and the DIY platforms themselves. Helpful "Investing Made Easy" books are readily available and understandable. I have used of a lot of this material myself over the last year and I'm really grateful for the time taken by the authors and participants to help and inform. But all this help should be making more inroads than it is.

I suppose we could ask why does it matter? If the majority of people are not comfortable with investing then why should they be encouraged to do so. This might be a sensible response in a world where not so much lay at the door of the individual. In the days of the Defined Benefit pension and co-operative financial institutions such as Building Societies personal finance didn't need to be quite so personal. However many sensible people these days are not even including receiving a state pension in their financial planning. It seems that, (sadly in my opinion - and dangerously too) the state is "letting go" of its responsibility to be mindful of the financial well-being of all its citizens.

Earned wealth is dropping and "grown" wealth is growing. This makes it even more important that ordinary people (what used to equate to the working and lower middle class) start to see the benefit of investing their money. Maybe the newer types of "investment" that don't carry the old fear factor - things like peer-to-peer lending and crowd funding might be a less daunting way into the whole process for some people. Despite the fact that they are often inherently just as risky, they do seem more transparent than the whole cult of "Wealth Management", with its performance charts, asset allocation, diversification, ETFs, Bonds and a multitude of other incomprehensible terms, rules, calculations and acronyms.

All in all, I have had a very interesting year teaching myself the ways of the dark art. I have learnt a lot and although I know that I still have a lot to learn, I have found the whole process incredibly satisfying and engaging. What worries me is that most people don't have the time, inclination or interest to do the legwork, nor the money to pay someone else to do it for them. This fact will do nothing to halt the growing trend towards wealth inequality.

Investing still isn't simple enough, probably because it isn't in the interest of the industry to make it so. This is something we should all be concerned about.

Monday, 9 February 2015

Reducing the Pain of Equity Release

Some 15 years or so ago my parents took out an equity release mortgage with Northern Rock. They inherited a large house when first married which they have lived in since and which they have always been adamant they never want to leave, but it's a very old building, difficult to heat and, at the time they took out the mortgage, needed a new roof and various other repairs. They borrowed a significant lump sum at an interest rate of 7.25%.

I have just seen the paperwork for the first time and was shocked to realise that the debt is going up at current rate of £11,000 per year. However, the debt doesn't have to be repaid until the house is sold and the theory is that house prices should rise at a rate that will compensate for the interest. It's difficult to be sure that this has been the case as the house is a bit of a "one-off" and difficult to value but I have used the Lloyds house price calculator and it seems that they currently owe about 30% of the estimated value of the house.

I have been doing some reading around the subject as my parents have asked me to take a look at their more general financial situation and I have discovered that Northern Rock collapsed and the mortgage has been passed to Papilio UK who don't offer any new loans of this kind and don't even seem to be members of the Equity Release Council which is slightly worrying. My plan is to transfer the mortgage to another provider offering a lower interest rate (we could get 5.63% with Aviva) and hopefully release a little more equity which could be used to clear a (recently discovered) credit debt with an interest rate of over 18%.

Given my parents' situation they had few options available back then when the roof needed fixing as the only asset they had was the house. It made sense, and still does, to use that asset to give them the retirement they want, where they want it. I just need to help them do it as painlessly as possible.

Does anyone have experience of this type of mortgage or see any flaws in my plan?

I have just seen the paperwork for the first time and was shocked to realise that the debt is going up at current rate of £11,000 per year. However, the debt doesn't have to be repaid until the house is sold and the theory is that house prices should rise at a rate that will compensate for the interest. It's difficult to be sure that this has been the case as the house is a bit of a "one-off" and difficult to value but I have used the Lloyds house price calculator and it seems that they currently owe about 30% of the estimated value of the house.

I have been doing some reading around the subject as my parents have asked me to take a look at their more general financial situation and I have discovered that Northern Rock collapsed and the mortgage has been passed to Papilio UK who don't offer any new loans of this kind and don't even seem to be members of the Equity Release Council which is slightly worrying. My plan is to transfer the mortgage to another provider offering a lower interest rate (we could get 5.63% with Aviva) and hopefully release a little more equity which could be used to clear a (recently discovered) credit debt with an interest rate of over 18%.

Given my parents' situation they had few options available back then when the roof needed fixing as the only asset they had was the house. It made sense, and still does, to use that asset to give them the retirement they want, where they want it. I just need to help them do it as painlessly as possible.

Does anyone have experience of this type of mortgage or see any flaws in my plan?

Wednesday, 3 December 2014

Setting Targets for the Final Push

November 2015 will see my husband draw his last ever wage before retirement. So the next 12 months are the last opportunity for me to save and invest substantial amounts of money.

From next Dec until the day I retire we will only have about £350 to invest per month - that is around 25% of what we are currently putting away. I intend to continue to pay £50 in to my LGPS AVC (this can't be taken until I take my my pension which I intend to do at 63 but it can all be taken as part of the tax free lump sum so I think it's worth it) and also continue paying £45 into my CIS FSAVC until such time as I transfer it into my SIPP (not sure when this will be yet). The rest will go into my SIPP.

By the time we both have our defined benefit and state pensions in payment, along with our rental income, we will be up to around £37,000 which is more than enough to maintain our current standard of living. So it is only the years between when I retire and when I get my LGPS pension at 63 that I need to worry about. I have estimated that the minimum income I require each year to take the household total up to the £28,500 we need (with £32,000 being a more comfortable target) is £12,500 until 2018 when my husband draws state pension and £6,800 from then till I draw my LGPS. The sooner I have enough to cover this, the sooner I can retire. But, of course, the sooner I retire, the more I need to cover.

The equation's quite tricky but after some deliberation I've come up with the following conclusions/key facts:

From next Dec until the day I retire we will only have about £350 to invest per month - that is around 25% of what we are currently putting away. I intend to continue to pay £50 in to my LGPS AVC (this can't be taken until I take my my pension which I intend to do at 63 but it can all be taken as part of the tax free lump sum so I think it's worth it) and also continue paying £45 into my CIS FSAVC until such time as I transfer it into my SIPP (not sure when this will be yet). The rest will go into my SIPP.

By the time we both have our defined benefit and state pensions in payment, along with our rental income, we will be up to around £37,000 which is more than enough to maintain our current standard of living. So it is only the years between when I retire and when I get my LGPS pension at 63 that I need to worry about. I have estimated that the minimum income I require each year to take the household total up to the £28,500 we need (with £32,000 being a more comfortable target) is £12,500 until 2018 when my husband draws state pension and £6,800 from then till I draw my LGPS. The sooner I have enough to cover this, the sooner I can retire. But, of course, the sooner I retire, the more I need to cover.

The equation's quite tricky but after some deliberation I've come up with the following conclusions/key facts:

- The earliest date I can hope to stop working is March 2016. This may happen if the offer of voluntary redundancy/early retirement materialises next year.

- I could only really take this up if my redundancy pay would be around £20,000 (as expected) and/or my pension would become payable immediately as part of the deal.

- Without the help of redundancy payments I would need around £80,000 saved in my personal pensions to leave at this date. The bottom line is that we do already have this in our combined funds, but our overall plan includes leaving our S&S ISA capital alone in case we need it for care fees etc so I'm avoiding bringing that and our £20,000 cash emergency fund into the equation. (Although I am allowing myself to figure 3% dividends from the ISA as being available to top up our income).

- Currently my personal pension stands at £24,600 and I am paying a total of £845 per month into it (made up to £1,057 by HMRC). By March 2016 this can only be expected to have grown to about £40,000 which won't be enough no matter how I cook the books.

- By March 2017 (the date at which I would realistically like to retire) my personal pension should have increased to around £45,000 (given the reduction in contributions in a year's time). At this point I will need £67,500. So I am short by £22,500 before I figure in ISA dividends. Taking those into account at around £2,000 per year, I am still £10,500 short. (I need £55,500 in total).

- If I reduce my ISA payment from £300 to £100 per month I could increase my monthly payment into my personal pension for the next 12 months to £1,045 (£1,300 after tax credit). In addition to the reduced contributions (£250/£300 per month) for the remaining 16 months to March 2017 I should have £48,000 which still leaves me £7,500 short.

- I need to reduce spending enough to be able to up my pension payments to around £1400 per month for the next 12 months or I need to be prepared to reduce our emergency fund to £10,000, or a combination of both to cover the shortfall.

- Save at least £1045 per month in my SIPP/FSAVC

- Save £100 per month in my ISA

- Look at spending very carefully - try to cut back by at least £100 per month to allocate for boosting pension even further.

- Cross fingers and hope the markets don't dive :-)

Thursday, 25 September 2014

The Feminine Touch

At the weekend I was reading Tim Hale (again) and I came across this statement:

It's such a shame then that so few of us actually do it. Maybe that's because we don't have control of as much of the wealth. Research in 2013 showed an average 17% difference between the wealth held by men and that held by women whilst:

"Overconfidence destroys wealth. Men tend to be more overconfident than women... men trade 45% more than women, This is reflected in risk-adjusted returns 1.4% less a year than women". (Hale. T., Smarter Investing, 3rd ed p89)Apparently we women have something in our genes that makes us better investors, just like we are statistically better drivers and probably for much the same reasons. We tend to be more cautious, less aggressive and less inclined to take risks. (I just wonder how long it will be before some bloke turns this around by saying that although women are involved in less investing "accidents" they cause them by not getting out of his way fast enough :-))

It's such a shame then that so few of us actually do it. Maybe that's because we don't have control of as much of the wealth. Research in 2013 showed an average 17% difference between the wealth held by men and that held by women whilst:

"At one point, between the ages of 24 and 34, the Wealth Gap can be as wide as 185 per cent with men claiming an average wealth of "£21,827 compared to just £7,648 (by women)."

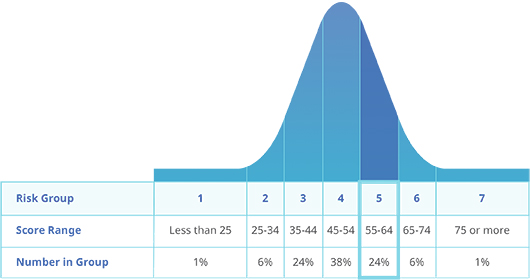

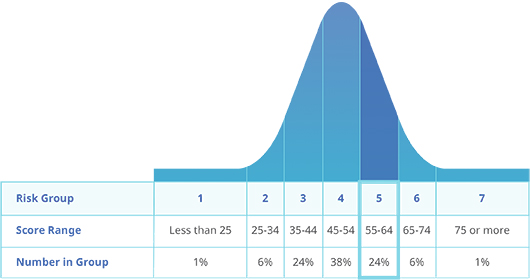

There an interesting article in April's Money Observer discussing how men and women differ in their attitudes towards investing and yet another in July which carries this infogram

This is all pretty serious and we really should get our act together, especially as far as pensions are concerned, because we're lagging seriously behind our male counterparts:

I am lucky in that I have managed to reach the same level of earnings as my husband (having got my MSc as a mature student after the kids went back to school) but I was financially dependant on him for the 10 years I was at home whilst they were little. It can be very uncomfortable indeed, even if it is never raised as an issue, as you can't really avoid feeling that you don't deserve as much of a say in the household finances. Unfortunately I'm not sure that there is a way round this, especially given the fact that such low status is traditionally given to the job/career of bringing up children. Financial equality between the genders is a really hard nut to crack and it may never actually be achieved.

Depressing though that thought is, we do have to deal with it and it seems to me that the only way that women can really support themselves to the same level as men is to be extra clever, start very early, use our innate "cautious" gene to invest well, save more than our male counterparts in those precious pre-kids years (which are also unfortunately the expensive "freedom years" for leisure and travel) and build a career that will welcome us back once family responsibilities lessen. In the meantime employing all our organisational skills and attention to detail to the task of living well, but frugally. Job done :-)

Of course, all this is generalisation. In our household I do all the investing but I do have to make sure that I manage my husband's ISA at a far lower level of risk than I do my own, as he is of a far more cautious bent than I. I'm pretty sure that he would not be comfortable with the risk profile of a couple of my funds, but he tends to act in much the same way as I sometimes do when he's driving - he closes his eyes, crosses his fingers and lets me get on with it.

This is all pretty serious and we really should get our act together, especially as far as pensions are concerned, because we're lagging seriously behind our male counterparts:

"Women retiring this year are nearly three times as likely as men to have only the state pension to live on, according to a report by the insurer Prudential. Some 20% of women, who often take career breaks or work part time to support families, said they have no other pension provision, compared with 7% of men, the research found" (The Guardian April 2014).I'm absolutely not in favour of creating further financial "dependency" by putting in place statutory measures to tie women's finances to men (as seen with the old "married women" reduced NI contributions etc) but I really don't see how we can ever be playing on a level pitch with men due to the time we spend out of the labour market having, and raising, kids. Or for the fact that we aren't given jobs even if we have no intention of doing so ( 40% of employers would rather employ a young male rather than a young female just on the basis that he won't be asking for maternity leave).

I am lucky in that I have managed to reach the same level of earnings as my husband (having got my MSc as a mature student after the kids went back to school) but I was financially dependant on him for the 10 years I was at home whilst they were little. It can be very uncomfortable indeed, even if it is never raised as an issue, as you can't really avoid feeling that you don't deserve as much of a say in the household finances. Unfortunately I'm not sure that there is a way round this, especially given the fact that such low status is traditionally given to the job/career of bringing up children. Financial equality between the genders is a really hard nut to crack and it may never actually be achieved.

Depressing though that thought is, we do have to deal with it and it seems to me that the only way that women can really support themselves to the same level as men is to be extra clever, start very early, use our innate "cautious" gene to invest well, save more than our male counterparts in those precious pre-kids years (which are also unfortunately the expensive "freedom years" for leisure and travel) and build a career that will welcome us back once family responsibilities lessen. In the meantime employing all our organisational skills and attention to detail to the task of living well, but frugally. Job done :-)

Of course, all this is generalisation. In our household I do all the investing but I do have to make sure that I manage my husband's ISA at a far lower level of risk than I do my own, as he is of a far more cautious bent than I. I'm pretty sure that he would not be comfortable with the risk profile of a couple of my funds, but he tends to act in much the same way as I sometimes do when he's driving - he closes his eyes, crosses his fingers and lets me get on with it.

Monday, 4 August 2014

Knowing When ...

The mantra "Thou shalt not take thy pension early for that way actuarial reduction lies" is very well known to those of us with defined benefit pensions.

This "rule" has always made sense to me (and it still does when applied to the majority of people in the majority of situations) and so I have been planning my early retirement to comply with it and haven't questioned the wisdom of waiting until 66 to take my pension. However failing to question a general rule in the light of your own particular circumstances can be a mistake and, as the LGPS has now released the details of the 2014 pension scheme and the protections that have been put in place for those of us who have long service, I decided to take a closer look. After some time with a calculator and spreadsheet these are my thoughts and findings:

The result is that I have reduced my target for my SIPP/FSAVC to £37,000 to give me a lump sum of £9,250 and a drawdown of £9,250 for the 3 years. This is still probably a touch high but there are all kinds of unknowns such as the status of the tax free lump sum and the personal tax threshold - a new government might make changes that could have a big impact. Also it's not yet completely clear how drawdown will work post 2015.

The result is that I have reduced my target for my SIPP/FSAVC to £37,000 to give me a lump sum of £9,250 and a drawdown of £9,250 for the 3 years. This is still probably a touch high but there are all kinds of unknowns such as the status of the tax free lump sum and the personal tax threshold - a new government might make changes that could have a big impact. Also it's not yet completely clear how drawdown will work post 2015.

All this doesn't mean that I will be saving less, just putting it in different pots to get the balance right and making sure I don't leave it to cook for too long. Timing is all important, it's not just a matter of what you put into the pot, it's also about when you take it out and enjoy it.

This "rule" has always made sense to me (and it still does when applied to the majority of people in the majority of situations) and so I have been planning my early retirement to comply with it and haven't questioned the wisdom of waiting until 66 to take my pension. However failing to question a general rule in the light of your own particular circumstances can be a mistake and, as the LGPS has now released the details of the 2014 pension scheme and the protections that have been put in place for those of us who have long service, I decided to take a closer look. After some time with a calculator and spreadsheet these are my thoughts and findings:

- I had been aiming to save enough in my SIPP and FSAVC to fund the 6 years between 60 and 66 at a level just below the personal tax threshold level and supplement to the required level with income from our ISAs. As I have a small Civil Service pension and share the income from our rental flat with my husband this means that I was planning on raising a total pension pot of £48,000 (6 x £8,000).

- In the local government scheme there has always been what is called a CRA (critical retirement age). This differs from both the normal (state) retirement age and the scheme retirement age. It is calculated using the rule of 85 - i.e. it is reached when length of service in the scheme and age, when added together, reach 85. My membership started in Nov 1995. If it continues to my 60th birthday (2019) I will have 23 complete years of membership. Therefore I will satisfy the rule when I am 62 (in March 2021).

- At CRA certain protections to my pension are applied one of which is that pre-2008 pension entitlement can be taken without reduction.

- The actuarial reduction applied to my post-2008 pension is a complex calculation applied at two different levels because the 2008 - 2014 pension has a retirement age of 65 and the 2014 onwards bit of the pension has a retirement age of 66.