Personal Finance is all about control and FiRe chasers have to be the biggest control freaks in the game. If we don't have all the strings in a firm grip, know exactly how long they are and when to pull them, how else are we going make it happen?

But there are times when the best strategy is to stop trying to make things happen and sit back and ride it out. It's fast looking as if this is one of those times. I've never "seen" a market crash or bear market. Of course I've lived through them, I've even been invested through them as I've held, and regularly paid into, a S&S ISA for around 10 years. However up until 18 months ago I wasn't remotely interested in what I was actually doing or even tracking how things were going, apart from glancing at the annual statements and thinking "that doesn't seem to have gone up much" (or the opposite). I was far too busy with kids, life, work and all the rest. This time it's very different.

Letting go of control and not being able to do anything but roll with the punches, sounds and feels more than a little scary until you realise that doing so should actually be part of the plan. Exactly as a pilot trusts his instruments to know better than he does at times, so we have to trust our PF plan to work to our best advantage when we can't see what's ahead (and as Monevator said at the weekend if you haven't got a plan get one quick:-)) Leaving the plan to do what it's meant to do is the whole reason we have it, it's there to prevent us having to make decisions when we don't have the tools to be able to do so.

I recently watched a television documentary about the terrible Staines air crash in 1972 which killed 118 people. The causes of the accident were complex but at least some of the blame has been placed with the pilot who, just before take off, had had a violent disagreement with a fellow pilot and so can be presumed to have been in an heightened emotional state. It appears that whilst the plane was coming out of take off he didn't climb quite high enough and then, when problems started to become apparent, an automatic stall warning and recovery system were overridden. As a result the plane went into a "deep stall" (from which recovery is impossible) and fell to the ground. Human intervention and faulty decision making disrupted the pre-programmed routines of the take off and tragedy ensued. The parallels with investing are clear.

(Incidentally the notion of a "deep stall" during which nothing can be done to pull the plane back up seems to me to have a financial equivalent in the situation in which many people who take out pay day loans find themselves. No matter what is done, it must feel like even the possibility of control has been lost. Apparently 44% of people who take out such loans use them for everyday essentials such as food.)

Markets across the world are tumbling, and for the first time I'm watching it happen. I'm very glad that I sold our CIS UK Growth funds a couple of months ago and took out the cash that we will need for the next two years as there is no indication of when things will recover and according to some commentators we could be in for a very bumpy time.

For now I'm going to sit tight and see what happens. (Well apart from buying £580 more of the Scottish Mortgage Trust we hold in my husband's ISA which has dropped over 7% since Friday. My husband has just received the final payment from his pension TFLS due when he retired so we have a little extra spare cash). I'll also be buying my Monkey Stocks on iii's next regular investments day towards the end of Sept. Who knows, they may be very cheap indeed by then :-)

Showing posts with label Risk. Show all posts

Showing posts with label Risk. Show all posts

Monday, 24 August 2015

Time to Switch to Auto PIlot

Monday, 23 February 2015

SWR - Who Cares?

Safe Withdrawal Rate (the % of a pot of money that can be taken each year without fear of it running out before the grim reaper strikes) is a topic much discussed on FI boards and blogs. However I only have a passing interest in the subject because I don't really have a pension "pot". I'm one of those lucky people with a (modest) DB pension that will never run out and will keep going as long as I do. It's index linked and 50% of it will pass to my husband if I die before he does. So once I get to 66 I'm sorted.

My problem consists of funding the years between 58 (when I hope to retire) and 65 (when I intend taking my pension). My calculations are not around working out how much I can take, they are based on having enough there in the first place. It doesn't matter to me if it all goes and I do have the luxury of knowing how long it has to last, but it does have to be there. I'm very close to needing the money (two years this month) and still a fair way off from having it. I need the pot to grow but I haven't got a lot of time. If it shrinks dramatically I could be looking at working longer or not sleeping at nights when I do leave, so I need to secure my income for those years as tightly as possible. How to do this?

I have no training in economics and failed A level maths 3 times (this and learning to drive are the two things I've allowed myself to fail at in my life) and the dynamics of the markets is something I've only just started to take an interest in. Financial products and how to manage money (beyond the basics) is an art I'm only just learning but I think these are the two areas I need to work on.

This should be the easy bit. Working on the premise that we will need as much as we are spending now I have calculated that I will need to secure an income of £930 per month for the 20 months before my husband receives his state pension and £505 for the 64 months after until my pension becomes payable. Total = £50,920.

But at this point I am already making two assumptions:

This process also tells me something quite important: I need a substantially higher amount of income in the first two years than I do for the following 5.

This is the tricky part. In simple terms I could just plan to save the whole amount in cash, put it in a bank account and draw out what I need each month. The problem with this is that I'm getting very nervous about whether or not I'll actually have the full amount. I have £29,600 at the moment but that could be £25,000 next week, or £32,000 depending on what the markets do. In any case I definitely need to ramp up my saving to reach my target and this will be made very difficult due to the fact that our disposable income will shrink massively in a few months when my husband retires.

According to received wisdom I shouldn't really have any of my pension in equities at all since I will need to draw on it in 2 years time. Thankfully a good chunk of it (around £19,000) is safely stored in my CIS FAVC but I will have to transfer it out in order to draw it so I will need to have worked out what to do with it by then. Maybe I shouldn't actually put this in my SIPP for drawdown but put it into a "high" interest current account instead and use it to fund the first two, most expensive, years of retirement?

It's very difficult to see how things will pan out given that we don't yet know how pension drawdown will work under the new rules so maybe when this becomes clearer I will be able to put together a firmer plan. But my more immediate dilemma is that I need my SIPP to grow but I shouldn't risk the volatility that this requires. According to my calculations I'll have just enough, but only just and only if....

I know the solution of course, spend less, save more. Any kind of withdrawing, safe or otherwise, depends on the funds being there in the first place. Perhaps I need to concentrate more on tactics for saving than worry so much about where to put the money and how to make it grow.

Having more than enough is the only way to be confident that I won't run out and it's time I acknowledged this, bumped up my targets (see below) and got on with it.

(The money in Adundance is an interesting addition because it works in quite a different way from the rest of my investments. A chunk of capital is returned each year and, so long as the project you are invested in doesn't fail (which is a risk), you can be fairly confident of that return. So this level of investment should give me a return of around £650 - £700 pa.)

My problem consists of funding the years between 58 (when I hope to retire) and 65 (when I intend taking my pension). My calculations are not around working out how much I can take, they are based on having enough there in the first place. It doesn't matter to me if it all goes and I do have the luxury of knowing how long it has to last, but it does have to be there. I'm very close to needing the money (two years this month) and still a fair way off from having it. I need the pot to grow but I haven't got a lot of time. If it shrinks dramatically I could be looking at working longer or not sleeping at nights when I do leave, so I need to secure my income for those years as tightly as possible. How to do this?

I have no training in economics and failed A level maths 3 times (this and learning to drive are the two things I've allowed myself to fail at in my life) and the dynamics of the markets is something I've only just started to take an interest in. Financial products and how to manage money (beyond the basics) is an art I'm only just learning but I think these are the two areas I need to work on.

Assess how much I need to live on.

But at this point I am already making two assumptions:

- that our rental property will bring in at least £4,000 pa

- our ISA's will have grown to £70,000, won't lose value dramatically and will pay 3% dividends giving us at least £2,000 pa.

This process also tells me something quite important: I need a substantially higher amount of income in the first two years than I do for the following 5.

Work out how much I need to produce this income and how to secure it when I've got it.

According to received wisdom I shouldn't really have any of my pension in equities at all since I will need to draw on it in 2 years time. Thankfully a good chunk of it (around £19,000) is safely stored in my CIS FAVC but I will have to transfer it out in order to draw it so I will need to have worked out what to do with it by then. Maybe I shouldn't actually put this in my SIPP for drawdown but put it into a "high" interest current account instead and use it to fund the first two, most expensive, years of retirement?

It's very difficult to see how things will pan out given that we don't yet know how pension drawdown will work under the new rules so maybe when this becomes clearer I will be able to put together a firmer plan. But my more immediate dilemma is that I need my SIPP to grow but I shouldn't risk the volatility that this requires. According to my calculations I'll have just enough, but only just and only if....

I know the solution of course, spend less, save more. Any kind of withdrawing, safe or otherwise, depends on the funds being there in the first place. Perhaps I need to concentrate more on tactics for saving than worry so much about where to put the money and how to make it grow.

Having more than enough is the only way to be confident that I won't run out and it's time I acknowledged this, bumped up my targets (see below) and got on with it.

| Targets | Current |

| ISAs - £70,000 | 65,344 |

| Pension - £50,000 | 29,600 |

| Abundance Gen - £7,500 | 1,500 |

| Cash - £22,500 | 22,000 |

| Total - £150,000 | 118,444 |

| Isa To Go | 4,656 |

| Pension To Go | 20,400 |

| Cash To Go | 500 |

| Abundance To Go | 6,000 |

| Total To Go | 31,556 |

(The money in Adundance is an interesting addition because it works in quite a different way from the rest of my investments. A chunk of capital is returned each year and, so long as the project you are invested in doesn't fail (which is a risk), you can be fairly confident of that return. So this level of investment should give me a return of around £650 - £700 pa.)

Saturday, 13 December 2014

Knowing When to Sell

This week I flexed my developing investing muscles in a new direction. I forced myself to sell something that was doing very well and it was much harder than I expected.

My reasoning process was sound (I think), the fund (Axa Framlington Biotech) has risen over 20% in the 8 weeks I have held it and I can't see it continuing to rise steeply for much longer (it actually dropped 1.66% the day after I sold). Even if it does continue to gain I had definitely started to feel that it was time to take some profit so I sold £500 worth, which was about the amount my investment had gained since I bought it. However, my emotions played havoc with my common sense in a "But what if you sell and it goes up more - you'll be sorry then won't you?" kind of way which was unforeseen and I didn't like. It smacked too much of unreasoning greed. I steadfastly refused to listen to my inner "kid in a sweetie shop" and pressed "Sell". For this reason I will consider this a successful sale even if the finances don't turn out to maximum advantage, because I've now proved to myself that I am very aware of the part emotions play in investing and I am capable of overriding them. I felt the greed and did it anyway.

My reasoning process was sound (I think), the fund (Axa Framlington Biotech) has risen over 20% in the 8 weeks I have held it and I can't see it continuing to rise steeply for much longer (it actually dropped 1.66% the day after I sold). Even if it does continue to gain I had definitely started to feel that it was time to take some profit so I sold £500 worth, which was about the amount my investment had gained since I bought it. However, my emotions played havoc with my common sense in a "But what if you sell and it goes up more - you'll be sorry then won't you?" kind of way which was unforeseen and I didn't like. It smacked too much of unreasoning greed. I steadfastly refused to listen to my inner "kid in a sweetie shop" and pressed "Sell". For this reason I will consider this a successful sale even if the finances don't turn out to maximum advantage, because I've now proved to myself that I am very aware of the part emotions play in investing and I am capable of overriding them. I felt the greed and did it anyway.

The downturn in October actually caused me far less angst, maybe because hanging on when things are dropping is far easier than deciding when to sell when things are going up. Inactivity is always easier than action (or so I find anyway). Selling something that has been more or less standing still (as my CIS UK Growth fund has been doing for the last year or so) was also easy to do. But giving up something that is rising steeply (surely the time to do just that?) was a different matter altogether. I almost (but not quite :-)) hope I don't have to do it too often.

In all the reading I have done as a novice investor, the subject of when to sell is one on which I haven't actually found a great deal of help. But we all have to do it don't we? No matter how good we are at the long-term "buy and hold" strategy at some point we are all going to need to take the money out. Steep growth (i.e .growth at a high rate over a short period of time) will surely be mirrored by steep falls. If this averages out to excellent long term growth does this mean that the best strategy is still always buy and hold, even though it must also depend on when you want to realise the profit? What is the best way to manage very volatile funds/markets?

This is something of a testing time for me as I am pretty new to investing and I had been congratulating myself that I had weathered the (admittedly somewhat modest) downturns in my riskier funds without feeling too much pain. However I wasn't prepared for this side of the volatility coin. I've only been watching and actively managing my investments since March and haven't seen anything much in the way of gains so the way this particular fund has behaved has taken me by surprise. I've realised that I didn't (and still don't) have a strategy for dealing with this situation.

My sale this week was actually more a test of resolve over emotion than a move dictated by financial planning and although I still believe I did the right thing, I would like to be more sure and have the reasoning to back it up. As ever I'm probably searching for a non-existent perfect recipe, but any tips, or links to reading on this, would be very welcome.

My reasoning process was sound (I think), the fund (Axa Framlington Biotech) has risen over 20% in the 8 weeks I have held it and I can't see it continuing to rise steeply for much longer (it actually dropped 1.66% the day after I sold). Even if it does continue to gain I had definitely started to feel that it was time to take some profit so I sold £500 worth, which was about the amount my investment had gained since I bought it. However, my emotions played havoc with my common sense in a "But what if you sell and it goes up more - you'll be sorry then won't you?" kind of way which was unforeseen and I didn't like. It smacked too much of unreasoning greed. I steadfastly refused to listen to my inner "kid in a sweetie shop" and pressed "Sell". For this reason I will consider this a successful sale even if the finances don't turn out to maximum advantage, because I've now proved to myself that I am very aware of the part emotions play in investing and I am capable of overriding them. I felt the greed and did it anyway.

My reasoning process was sound (I think), the fund (Axa Framlington Biotech) has risen over 20% in the 8 weeks I have held it and I can't see it continuing to rise steeply for much longer (it actually dropped 1.66% the day after I sold). Even if it does continue to gain I had definitely started to feel that it was time to take some profit so I sold £500 worth, which was about the amount my investment had gained since I bought it. However, my emotions played havoc with my common sense in a "But what if you sell and it goes up more - you'll be sorry then won't you?" kind of way which was unforeseen and I didn't like. It smacked too much of unreasoning greed. I steadfastly refused to listen to my inner "kid in a sweetie shop" and pressed "Sell". For this reason I will consider this a successful sale even if the finances don't turn out to maximum advantage, because I've now proved to myself that I am very aware of the part emotions play in investing and I am capable of overriding them. I felt the greed and did it anyway.The downturn in October actually caused me far less angst, maybe because hanging on when things are dropping is far easier than deciding when to sell when things are going up. Inactivity is always easier than action (or so I find anyway). Selling something that has been more or less standing still (as my CIS UK Growth fund has been doing for the last year or so) was also easy to do. But giving up something that is rising steeply (surely the time to do just that?) was a different matter altogether. I almost (but not quite :-)) hope I don't have to do it too often.

In all the reading I have done as a novice investor, the subject of when to sell is one on which I haven't actually found a great deal of help. But we all have to do it don't we? No matter how good we are at the long-term "buy and hold" strategy at some point we are all going to need to take the money out. Steep growth (i.e .growth at a high rate over a short period of time) will surely be mirrored by steep falls. If this averages out to excellent long term growth does this mean that the best strategy is still always buy and hold, even though it must also depend on when you want to realise the profit? What is the best way to manage very volatile funds/markets?

This is something of a testing time for me as I am pretty new to investing and I had been congratulating myself that I had weathered the (admittedly somewhat modest) downturns in my riskier funds without feeling too much pain. However I wasn't prepared for this side of the volatility coin. I've only been watching and actively managing my investments since March and haven't seen anything much in the way of gains so the way this particular fund has behaved has taken me by surprise. I've realised that I didn't (and still don't) have a strategy for dealing with this situation.

My sale this week was actually more a test of resolve over emotion than a move dictated by financial planning and although I still believe I did the right thing, I would like to be more sure and have the reasoning to back it up. As ever I'm probably searching for a non-existent perfect recipe, but any tips, or links to reading on this, would be very welcome.

Saturday, 30 August 2014

"Almost" and "If Only..."

Last week I read an article on Interactive Investor discussing how to invest in the Internet of Things - a world in which everyday objects contain technology that connects them online.

We are beginning to explore this type of technology at work so I know a little about it and I also know that it is definitely a growth area so I was very interested to read about the some of the companies involved as potential investment opportunities.

The one which really caught my imagination was CSR and the more I read about the company and its products the more I began to wonder if this wasn't "the one" that would finally make me take the plunge and buy individual stocks. If I'd had my CIS funds in my ISA I do believe I would have gone ahead, sold a little of them and bought £1000's worth of CSR, but, not having available cash and not wanting to sell anything else, I just put the company on my watch list for the time being.

This is what happened two days later:

The stock went up by over 30% overnight.

I was stunned. To be honest although I "knew" that things were volatile out there in the market I have had my limited experience of it cushioned by the fact that I have been watching large funds move slowly up and down. This was the first time that I realised that things can actually move very fast indeed at individual stock level. Am I actually really ready for the type of environment where this was possible? Although I consider myself towards the top end of the "prepared to take a risk" spectrum", this has never actually been tested. Seeing first hand what happened with CSR and being so close to actually being in the thick of it has concentrated my mind on what I would actually be letting myself in for . It has given me the opportunity to think about what individual stock picking and its potentially higher level of risk/reward would mean to me.

These are some of the things I came up with:

Benefits

After all, I almost bought, I almost made a fair bit of money overnight. I now know how it feels to have to deal with "almost" and "if only" and it hasn't put me off.

(btw I still like the look of CSR. Hurry up ISA transfer :-))

We are beginning to explore this type of technology at work so I know a little about it and I also know that it is definitely a growth area so I was very interested to read about the some of the companies involved as potential investment opportunities.

The one which really caught my imagination was CSR and the more I read about the company and its products the more I began to wonder if this wasn't "the one" that would finally make me take the plunge and buy individual stocks. If I'd had my CIS funds in my ISA I do believe I would have gone ahead, sold a little of them and bought £1000's worth of CSR, but, not having available cash and not wanting to sell anything else, I just put the company on my watch list for the time being.

This is what happened two days later:

The stock went up by over 30% overnight.

I was stunned. To be honest although I "knew" that things were volatile out there in the market I have had my limited experience of it cushioned by the fact that I have been watching large funds move slowly up and down. This was the first time that I realised that things can actually move very fast indeed at individual stock level. Am I actually really ready for the type of environment where this was possible? Although I consider myself towards the top end of the "prepared to take a risk" spectrum", this has never actually been tested. Seeing first hand what happened with CSR and being so close to actually being in the thick of it has concentrated my mind on what I would actually be letting myself in for . It has given me the opportunity to think about what individual stock picking and its potentially higher level of risk/reward would mean to me.

These are some of the things I came up with:

Benefits

- The satisfaction of feeling more directly involved with the company in question. I really enjoyed researching CSR and reading about their development work.

- Technology is my "field" so I felt that I would be able to make a genuinely informed choice to invest rather than relying on the recommendations of financial pundits where I sometimes find it difficult to separate the genuinely knowledgeable from the salesmen.

- I would feel that I am investing more responsibly/ethically by choosing the company and area of business rather than leaving it to a find manager or tracking the whole market.

- I would learn far more about the business world and how that works which would be time well spent in preparation for actual retirement because at that point I intend to transform my portfolio into an income-producing rather than capital-building model.

- Excitement/ Enjoyment/Enrichment due to a feeling of getting things right

- Potential Financial Gain

- Loss of confidence if things go wrong

- Excitement/Over confidence/Too much risk taking

- Potential Financial Loss

After all, I almost bought, I almost made a fair bit of money overnight. I now know how it feels to have to deal with "almost" and "if only" and it hasn't put me off.

(btw I still like the look of CSR. Hurry up ISA transfer :-))

Saturday, 26 July 2014

Monte Carlo or Bust

Luckily for me I don't have to plan my retirement from the angle of "how long will my money last". I have an index-linked BD pension that, although modest, when combined with my husband's pension (also DB), state pension and flat rental, is enough to live on and will last as long as I do.

I feel very fortunate because the prospect of running "pension pot" figures through financial modelling software, and feeling confident enough about the results to be able to make firm decisions based on them, is daunting. Especially when you remember that sticking to the "safe side" and over-funding might very well leave you with a surplus that has cost you precious years of freedom, only to remain unspent because you died before the last row on your spreadsheet.

However, despite the fact that I don't need to use this kind of tool "in anger" I was interested to see how the modelling worked so I took a look at Firecalc which is one of the calculators widely recommended for the job. What surprised me most of all is that there doesn't seem to be a UK version so the figures you enter have all to be converted to $s. Also all the data that the calculations are based on is taken from the American markets. However it maybe just that my Google searches just didn't turn up the right results. I was looking for a direct UK equivalent to Firecalc but it is quite likely that a similar type of "Monte Carlo" simulating process is used by many of the other calculators on the market. More investigation needed.

Firecalc works by running your living costs, portfolio value and life expectancy through a series of calculations and gives you a % likelihood of "success" which has been assessed based on how the markets have performed in the past.

"FIRECalc shows you the results of every starting point, since 1871. You can get a sense of just how safe or risky your retirement plan is, based on how it would have withstood every market condition we have ever faced."

I ran my figures through it and this is the result:

The zero line is shown in red.

What my results mean

I feel very fortunate because the prospect of running "pension pot" figures through financial modelling software, and feeling confident enough about the results to be able to make firm decisions based on them, is daunting. Especially when you remember that sticking to the "safe side" and over-funding might very well leave you with a surplus that has cost you precious years of freedom, only to remain unspent because you died before the last row on your spreadsheet.

However, despite the fact that I don't need to use this kind of tool "in anger" I was interested to see how the modelling worked so I took a look at Firecalc which is one of the calculators widely recommended for the job. What surprised me most of all is that there doesn't seem to be a UK version so the figures you enter have all to be converted to $s. Also all the data that the calculations are based on is taken from the American markets. However it maybe just that my Google searches just didn't turn up the right results. I was looking for a direct UK equivalent to Firecalc but it is quite likely that a similar type of "Monte Carlo" simulating process is used by many of the other calculators on the market. More investigation needed.

Firecalc works by running your living costs, portfolio value and life expectancy through a series of calculations and gives you a % likelihood of "success" which has been assessed based on how the markets have performed in the past.

"FIRECalc shows you the results of every starting point, since 1871. You can get a sense of just how safe or risky your retirement plan is, based on how it would have withstood every market condition we have ever faced."

I ran my figures through it and this is the result:

FIRECalc Results

Your spending in every year after the first year will be adjusted for inflation, so the spending power is preserved.

Because you indicated a future retirement date (2019), the withdrawals won't start until that year. Your contributions will continue until then. The tested period is 5 years of preretirement plus 32 years of retirement, or 37 years.

FIRECalc looked at the 107 possible 37 year periods in the available data, starting with a portfolio of $212,206 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 107 cycles. The lowest and highest portfolio balance throughout your retirement was $212,206 to $2,932,303, with an average of $1,054,551. (Note: values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 37 years. FIRECalc found that 0 cycles failed, for a success rate of 100.0%.

Understanding the charts below: Don't try to follow any individual line -- with most scenarios, there are just too many of them. But if you look at the mass of lines, and the zero axis, you can get a clear visual representation of how frequently your strategy would have failed (dropped below zero) or succeeded. The objective of presenting the information this way is to allow you to get a "big picture" sense of the way your strategy would have performed historically.

Year-by-Year Portfolio Balances

The zero line is shown in red.

Predictably the success rate is 100%. However, what is interesting is the vast difference between the highest and lowest potential value of my portfolio - £1,727,271 down to £125,000. This is food for thought, as it seems that there is every chance I could have a substantial amount of savings left that won't be needed to live on in retirement.

I did sort of know this because the period of time I am trying to fund at the moment comes before our pensions kick in, not after. Despite knowing this I have felt reluctant to stop pumping up the ISAs as much as we can. However, it might be better to review this and investigate putting more in my private pension now to help us both retire another year earlier? However I'm not sure what the impact of not working for a further year would have on my LGPS pension so I need to work this out.

Two additional points to Note:

- I need to start to think about how we want to manage inheritance - How much to leave (or gift before we die?).

- Do we need to put something in place to manage potential care costs? Should we earmark some (or all) of the ISA fund for this? What is the best way to manage this?

Monday, 14 July 2014

Seeing Red

The standard advice to novice investors like me is "Don't keep checking what your investments are worth, turn off the portfolio tracker". The reasons for this are pretty obvious - the markets are inherently volatile and humans are inherently "easily spooked" (or most of us are).

My portfolio tracker currently looks like this:

So, according to Prospect Theory (people tend to be influenced more by the "prospect" of an investment - i.e. whether it is rising or falling than its actual value), I should be starting to feeling the fear and itching to do something about it. However, because I know that red in a portfolio tracker is inevitable due to the way the markets work, I'm happily keeping irrationality at bay.

Personally I don't believe that the way to deal with volatility is to pretend it doesn't happen and refuse to see it. Ignorance is not bliss as far as my investments go. I used that tactic for years and I'm sure their value suffered because of it. But the key here is "informed" involvement.

Knowledge of how things work does help to damp down our inbuilt emotional reaction to risk. I know that flying is statistically very safe, planes do not fall out of the sky (or do so very rarely). They are engineered so that this is virtually impossible and pilots are highly trained, skilled individuals. In the same way markets tend to recover and continue to rise, and periodic set backs are part of this process. Rationality insists that we sit tight when the markets drop, buy whilst prices are low and wait.

However, if the red figure on my whole portfolio reaches double digits and stays there for a while, which, my reading tells me it mostly likely will at some point, it might be more of an effort to keep my nerves steady.

However, if the red figure on my whole portfolio reaches double digits and stays there for a while, which, my reading tells me it mostly likely will at some point, it might be more of an effort to keep my nerves steady.

I have a strategy for dealing with my nerves when a flight becomes a little bumpy and it involves several stiff gin and tonics. I'm not sure that this is quite what financial experts have in mind when they advise how best to deal with stock market turbulence by saying "chose a strategy and stick to it."

My portfolio tracker currently looks like this:

| Portfolio name | Holdings | GBP Value | % of total | Performance | |||

|---|---|---|---|---|---|---|---|

| 1m | 6m | 1y | |||||

| Cerridwen | 16 | £73,554.96 | 76.08 | -1.9% | -1.4% | 5.7% | |

So, according to Prospect Theory (people tend to be influenced more by the "prospect" of an investment - i.e. whether it is rising or falling than its actual value), I should be starting to feeling the fear and itching to do something about it. However, because I know that red in a portfolio tracker is inevitable due to the way the markets work, I'm happily keeping irrationality at bay.

Personally I don't believe that the way to deal with volatility is to pretend it doesn't happen and refuse to see it. Ignorance is not bliss as far as my investments go. I used that tactic for years and I'm sure their value suffered because of it. But the key here is "informed" involvement.

Knowledge of how things work does help to damp down our inbuilt emotional reaction to risk. I know that flying is statistically very safe, planes do not fall out of the sky (or do so very rarely). They are engineered so that this is virtually impossible and pilots are highly trained, skilled individuals. In the same way markets tend to recover and continue to rise, and periodic set backs are part of this process. Rationality insists that we sit tight when the markets drop, buy whilst prices are low and wait.

However, if the red figure on my whole portfolio reaches double digits and stays there for a while, which, my reading tells me it mostly likely will at some point, it might be more of an effort to keep my nerves steady.

However, if the red figure on my whole portfolio reaches double digits and stays there for a while, which, my reading tells me it mostly likely will at some point, it might be more of an effort to keep my nerves steady.I have a strategy for dealing with my nerves when a flight becomes a little bumpy and it involves several stiff gin and tonics. I'm not sure that this is quite what financial experts have in mind when they advise how best to deal with stock market turbulence by saying "chose a strategy and stick to it."

Thursday, 3 July 2014

The "Storage Hunters" Effect

A lot has been written in recent months about "transparency" in investing, most of which has been in reference to charges.

However, as I see it, there is another way in which the concept of "transparency" should be applied from the investors point of view, and that is in regards to the way in which we are expected to accept a "Storage Hunters" - type deal when we buy funds. (For anyone who is not a regular Dave viewer "Storage Hunters" is an American programme based on the auctioning of the contents of storage lock-ups virtually "sight unseen." The buyers get a quick glimpse of what is inside but then they bid on "gut feeling" and instinct as to its actual value, egged on by the "auctioneer". As Reality TV goes it is probably one of the most manufactured examples , but also a little addictive. (Not that I've seen more than a couple of episodes for research purposes, of course :-))

When we buy an actively managed fund we are usually limited to the "Investment Objectives" mission-statement plus a list of the top ten holdings on which to base our decision, with historical fund and fund manager performance statistics added into the mix. Full listings of fund holdings are usually available at periodic intervals, but they are not widely published and are not easily accessible, particularly to investors who have not already "bought into" the fund in question. What the average investor has to go on is little more than Brandon and Lori have as they peek into the next container and speculate as to what is under the sheets.

When we buy an actively managed fund we are usually limited to the "Investment Objectives" mission-statement plus a list of the top ten holdings on which to base our decision, with historical fund and fund manager performance statistics added into the mix. Full listings of fund holdings are usually available at periodic intervals, but they are not widely published and are not easily accessible, particularly to investors who have not already "bought into" the fund in question. What the average investor has to go on is little more than Brandon and Lori have as they peek into the next container and speculate as to what is under the sheets.

However Neil Woodford has been in the news recently (yet again) as he has promised to disclose his entire portfolio and make it easily accessible to all. Perhaps this means that there will be a sea-change towards transparency from fund managers. It does seem to be a move in the right direction as a "sheets off" approach in all aspects of the finance industry can only be good for investors who want to be able to make informed decisions.

After all , we do need to be able to see exactly what we are putting into our pots in order to be able gauge its effect on the mix. and "sight unseen" should perhaps be one investment risk we could be avoiding.

However, as I see it, there is another way in which the concept of "transparency" should be applied from the investors point of view, and that is in regards to the way in which we are expected to accept a "Storage Hunters" - type deal when we buy funds. (For anyone who is not a regular Dave viewer "Storage Hunters" is an American programme based on the auctioning of the contents of storage lock-ups virtually "sight unseen." The buyers get a quick glimpse of what is inside but then they bid on "gut feeling" and instinct as to its actual value, egged on by the "auctioneer". As Reality TV goes it is probably one of the most manufactured examples , but also a little addictive. (Not that I've seen more than a couple of episodes for research purposes, of course :-))

When we buy an actively managed fund we are usually limited to the "Investment Objectives" mission-statement plus a list of the top ten holdings on which to base our decision, with historical fund and fund manager performance statistics added into the mix. Full listings of fund holdings are usually available at periodic intervals, but they are not widely published and are not easily accessible, particularly to investors who have not already "bought into" the fund in question. What the average investor has to go on is little more than Brandon and Lori have as they peek into the next container and speculate as to what is under the sheets.

When we buy an actively managed fund we are usually limited to the "Investment Objectives" mission-statement plus a list of the top ten holdings on which to base our decision, with historical fund and fund manager performance statistics added into the mix. Full listings of fund holdings are usually available at periodic intervals, but they are not widely published and are not easily accessible, particularly to investors who have not already "bought into" the fund in question. What the average investor has to go on is little more than Brandon and Lori have as they peek into the next container and speculate as to what is under the sheets.However Neil Woodford has been in the news recently (yet again) as he has promised to disclose his entire portfolio and make it easily accessible to all. Perhaps this means that there will be a sea-change towards transparency from fund managers. It does seem to be a move in the right direction as a "sheets off" approach in all aspects of the finance industry can only be good for investors who want to be able to make informed decisions.

After all , we do need to be able to see exactly what we are putting into our pots in order to be able gauge its effect on the mix. and "sight unseen" should perhaps be one investment risk we could be avoiding.

Wednesday, 11 June 2014

Getting the temperature right.

Risk is a vital component in any successful financial plan and attitude to risk is a major factor when considering how to invest. Getting it wrong can mean that the return on the investment is not sufficient, or not at the right level when it needs to be cashed in. Put the pot on too low a heat and it won't cook properly, too high and it is in danger of boiling over.

No-one wants to spend their days wondering why their pot has turned out to be lukewarm and not "cooked through", nor their nights worrying whether it will boil over, or its contents evaporate into the air just when they are needed.

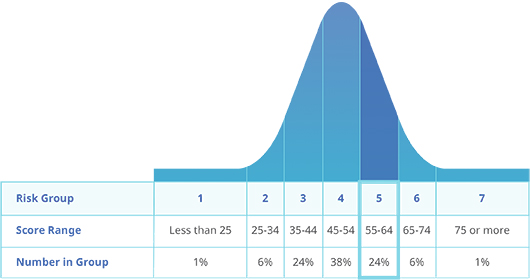

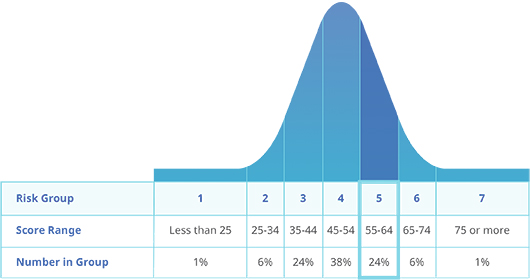

In order to help us with this tricky balancing act questionnaires have been developed that purport to be able to assess our attitude to risk and tell us where we stand on the scale between "batten down the hatches" and "devil may care". Following a link from ermine's post in March, I took the (free) Finametrica test. This is the result:

However I have the feeling that this high score says more about my current stable financial situation, my lack of responsibility for dependants and my "de-mob happy" feeling of being completely debt free rather than saying anything about an underlying personality trait. In other words my risk tolerance isn't an "attitude" at all but rather a reflection of my situation (which does, after all, include a modest, but valuable final salary pension). If I'd taken the test 20, or even 10, years ago I suspect that the result would have been very different.

There is a danger that the results of tests like these tend to stick with us as being true because they are supposed to be about us rather than about how we feel now, in our current situations. As such they could be in danger of being self-fulfilling, especially when coupled with the way investment types are graded into matching categories. In other words, I could take the test at 35, the result comes out as low tolerance to risk and from then on I put my money into investments that "match" my score despite the fact that 10 years later my situation is very different.

Personally I have a tendency to rely on concrete measures in order to inform my mix of investments rather than let myself be led by my "attitude". Maybe it is just that I feel fairly confident that I can count on my ability to research the facts. Perhaps this is a false confidence because it sometimes feels as if the "facts" are pretty hard to find under all the "gossip" out there in the financial press.

However, despite my seemingly reckless base nature (according to Finametrica) my portfolio actually has a low/moderate risk level (according to Trustnet it comes out at 78).

But maybe I should follow my instinct, relax a little, let my true highly risk-tolerant nature shine through and turn up the heat.

No-one wants to spend their days wondering why their pot has turned out to be lukewarm and not "cooked through", nor their nights worrying whether it will boil over, or its contents evaporate into the air just when they are needed.

In order to help us with this tricky balancing act questionnaires have been developed that purport to be able to assess our attitude to risk and tell us where we stand on the scale between "batten down the hatches" and "devil may care". Following a link from ermine's post in March, I took the (free) Finametrica test. This is the result:

Your Risk Tolerance Score enables you to compare yourself to a representative sample of the adult population. Your score is 64. This is a very high score, higher than 91% of all scores.

When scores are graphed they form a bell-curve as shown below. To make the scores more meaningful, the 0 to 100 scale has been divided into seven Risk Groups. Your score places you in Risk Group 5.

In answer to the last question, you estimated your score would be 58. Most people under-estimate their score by a few points. Yours was a slightly bigger under-estimate. When compared to others you are somewhat more risk tolerant than you thought you were.

However I have the feeling that this high score says more about my current stable financial situation, my lack of responsibility for dependants and my "de-mob happy" feeling of being completely debt free rather than saying anything about an underlying personality trait. In other words my risk tolerance isn't an "attitude" at all but rather a reflection of my situation (which does, after all, include a modest, but valuable final salary pension). If I'd taken the test 20, or even 10, years ago I suspect that the result would have been very different.

There is a danger that the results of tests like these tend to stick with us as being true because they are supposed to be about us rather than about how we feel now, in our current situations. As such they could be in danger of being self-fulfilling, especially when coupled with the way investment types are graded into matching categories. In other words, I could take the test at 35, the result comes out as low tolerance to risk and from then on I put my money into investments that "match" my score despite the fact that 10 years later my situation is very different.

Personally I have a tendency to rely on concrete measures in order to inform my mix of investments rather than let myself be led by my "attitude". Maybe it is just that I feel fairly confident that I can count on my ability to research the facts. Perhaps this is a false confidence because it sometimes feels as if the "facts" are pretty hard to find under all the "gossip" out there in the financial press.

However, despite my seemingly reckless base nature (according to Finametrica) my portfolio actually has a low/moderate risk level (according to Trustnet it comes out at 78).

But maybe I should follow my instinct, relax a little, let my true highly risk-tolerant nature shine through and turn up the heat.

Sunday, 20 April 2014

Buying "Clean" (Part 1).

I made another small buy into risk this week - £250 into iShares S&P Gbl Clean Energy. I did deliberate fairly long and fairly hard before doing so as it did feel like a bit of an indulgence. I don't know much about the industry and it is almost as risky as Shin Nippon with a TrustNet score of 176. But I really like the ethos behind the fund.

The S&P Global Clean Energy Index offers exposure to the 30 largest and most liquid listed companies globally that are involved in clean energy related businesses, from both developed markets and emerging markets

The news for clean energy has been an interesting mix recently (both on the ground and in the investment arena ) which means it is difficult to predict how things will go, but the amount I have put in is very small, I have nothing else in the energy/commodity range, it is an ETF so the fees are minimal and I do feel in tune with the product. I shall probably not add to this more than 3 or 4 times a year, possibly in rotation with the Shin Nippon.

So, I think my appetite for a little risk taking should now be satisfied.

I was finally spurred on to let myself have these two small indulgences by a comment I read on the moneysavingexpert forum. It was made in response to someone who, like me, has a decent public sector pension waiting for them at normal retirement age but who was wondering how to manage their investments in order to supplement this. Someone made the suggestion that perhaps they could think of their pension as a whole load of inflation linked gilts and plan the rest of their allocation accordingly. I had a bit of a light bulb moment when I read this because it makes perfect sense and gives me a reason to put my ISA funds into equities without having to worry too much about balancing this with fixed income.

I appreciate that the time-frame is important with all this and that when I am going to need the money I will have to start moving the risky bits into something that is less likely to bomb but, as far as the biggest part of the ISA is concerned, this shouldn't be for around 8 -10 years.

The SIPP that I have just started is a different matter and I intend to take a lot more care with ensuring that this will not be prone to massive jumps and dips as I will definitely need that in 8 years. My FSAVC, which I will need in 5, is invested in a very safe fund with a Trustnet risk rating of 8, so I'm not going to worry about that one especially as I phoned them this week (I am well overdue an annual statement) and it has risen by around £1,300 over and above what I put in this year and so seems to be on track to give me the £22,000 I will need in 5 years time.

So, all-in-all, I'm not feeling too reckless and irresponsible by raising my risk profile and investing in the future of the planet (and that's a whole other post).

The S&P Global Clean Energy Index offers exposure to the 30 largest and most liquid listed companies globally that are involved in clean energy related businesses, from both developed markets and emerging markets

The news for clean energy has been an interesting mix recently (both on the ground and in the investment arena ) which means it is difficult to predict how things will go, but the amount I have put in is very small, I have nothing else in the energy/commodity range, it is an ETF so the fees are minimal and I do feel in tune with the product. I shall probably not add to this more than 3 or 4 times a year, possibly in rotation with the Shin Nippon.

So, I think my appetite for a little risk taking should now be satisfied.

I was finally spurred on to let myself have these two small indulgences by a comment I read on the moneysavingexpert forum. It was made in response to someone who, like me, has a decent public sector pension waiting for them at normal retirement age but who was wondering how to manage their investments in order to supplement this. Someone made the suggestion that perhaps they could think of their pension as a whole load of inflation linked gilts and plan the rest of their allocation accordingly. I had a bit of a light bulb moment when I read this because it makes perfect sense and gives me a reason to put my ISA funds into equities without having to worry too much about balancing this with fixed income.

I appreciate that the time-frame is important with all this and that when I am going to need the money I will have to start moving the risky bits into something that is less likely to bomb but, as far as the biggest part of the ISA is concerned, this shouldn't be for around 8 -10 years.

The SIPP that I have just started is a different matter and I intend to take a lot more care with ensuring that this will not be prone to massive jumps and dips as I will definitely need that in 8 years. My FSAVC, which I will need in 5, is invested in a very safe fund with a Trustnet risk rating of 8, so I'm not going to worry about that one especially as I phoned them this week (I am well overdue an annual statement) and it has risen by around £1,300 over and above what I put in this year and so seems to be on track to give me the £22,000 I will need in 5 years time.

So, all-in-all, I'm not feeling too reckless and irresponsible by raising my risk profile and investing in the future of the planet (and that's a whole other post).

Subscribe to:

Posts (Atom)