My application for Voluntary Redundancy has been accepted and all the playing with spreadsheets and financial wheeling and dealing I've been doing over the last 2 years turns out to have been completely unnecessary. Early retirement landed on my plate, courtesy of Government cuts, and I finish on 31st March 2016.

The group of us who got letters immediately ticked the box and delivered our acceptances to HR en masse. There was something of a party atmosphere going on. We're virtually all long serving older people able to access our pensions early, with a redundancy payment on top, so we're sitting pretty. It couldn't have worked out better for us but it wouldn't have happened at all in better times under better governance. My feelings are slightly mixed, but not very. Mostly I'm still pinching myself and wondering how I got so lucky and having surreal discussions with my boss about things like putting my "Out of Office" on my mail shortly after Christmas so that people get used to the fact that I'm not going to be there any longer.

|

I'm going to quote in full a paragraph that struck a particular chord with me and made me think about the implications of my financial activity over the course of the last two years in quite a different way.

"More fundamentally than any of this, though, is their (the climate change deniers) deep fear that if the free market system really has set in motion physical and chemical processes that, if allowed to continue unchecked, threaten large parts of humanity at an existential level, then their whole crusade to morally redeem capitalism has been for naught. With stakes like these clearly greed is not so good after all. And that is what is behind the abrupt rise in climate change denial among hardcore conservatives: they have come to understand that as soon as they admit that climate change is real, they will lose the central ideological battle of our time - whether we need to plan and manage our societies to reflect our goals and values, or whether that task can be left to the magic of the market."

When I started this blog financial management and investing were largely a completely unknown and mysterious art to me but, as I read and learned, I came to realise that here was maybe a way to get out of the job that I had begun to dislike. At that time this was the top and bottom of it. Just me working things out to help me get what I wanted. Nothing to do with the bigger picture, and certainly nothing that could possibly impact on where the world was going.

However, that learning and reading moved on and my thinking about the whole subject of investing began to get a little uncomfortable at times. This resulted in my divesting from fossil fuels (at least where I could - i.e. where I knew I had stock), re-investing in green energy and generally taking an interest in finding ethical ways to use and grow my money.

Because there is a basic dilemma here for the investor. Those of us in the FiRe community are very scathing and dismissive about consumerism but our success as investors depends on it - surely we're guilty of more than a little hypocrisy here? We may sneer about people buying big cars and splashing out on "things" but if we're invested in this behaviour and profiting from it does that make us any better?

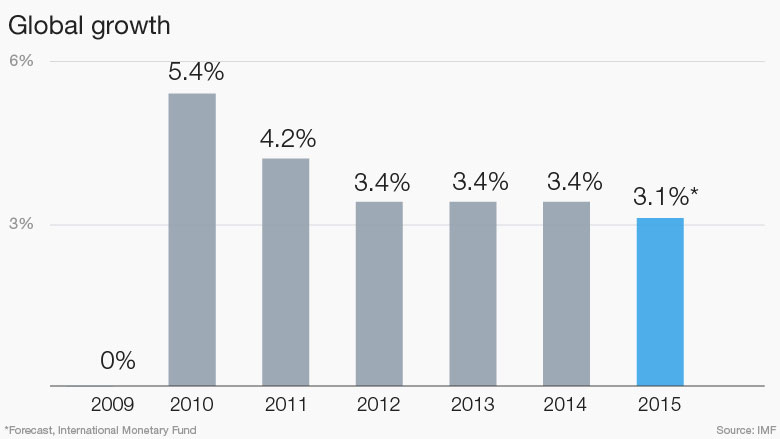

In addition, this drive for continual growth that we're part of is causing untold damage that will massively impact the lives of our grandchildren's generation. Shouldn't we be taking part of the blame, acknowledging the consequences and doing something about it, rather than simply bunging as much money as we can in SIPPs and JISAs for the next generation. The world they are going to have to cope with might be made a little better for individuals by having enough money to live somewhere that isn't in danger of flooding or drought (just yet), but food supplies will become restricted, borders fenced and patrolled and news headlines increasingly harrowing. Not the kind of world any of us want for our children, grandchildren or the kid next door (in the global sense of course).

Although Naomi has plenty of ideas on how to make things work differently and the tone of her work is generally positive, I don't think human nature is such that we will see sense and take her up on them in enough numbers. Change is needed at the political level and we're certainly not going in the right direction at the moment.

There may be an agreement of sorts in Paris but it won't be enough and it's probably already too late, unless

a miracle occurs. "Business as usual" will win. It seems that at the end of the day it may be that we can only do what we know to be right as individuals. Plenty of people do see the need for change, so supportive community-based forces striving to make things better will grow in strength, and I intend to be part of that. But I don't expect it to work.

We have plans for a possible re-location to Scarborough, and I have plans for lots of other things too. Becoming a volunteer at CAB is one, as is investigating helping out with some of the growing number of community initiative food projects, such as FoodCycle. I going to be very busy.

Goal achieved and new horizons looming. For these reasons this will be my last post.

I would like to thank the FiRe community for their fantastic support over the course of my journey. However, I know that my stance in this post will not be shared by some readers out there so, for this reason, I am disabling commenting. I hope you will forgive me the indulgence of ensuring that the last words on my blog are my own.

Health and Happiness to all :-)